7 Stocks That Deserve A Spot On Your Watchlist

Names leading & worthy of tracking.

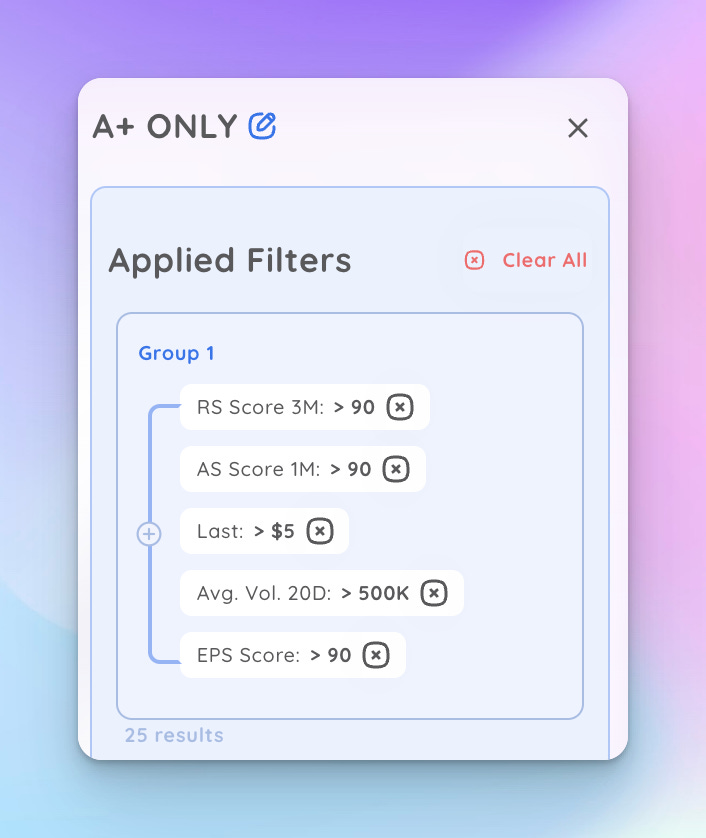

One of my favorite scans to run as the market pulls back is called “A+ Only”, with the goal of returning the highest quality stocks the market has to offer. Running this screen helps me stay focused on the best of the best, and produced the list that I will run through below.

I sent out the A+ ONLY screen to the Paid Subscribers of Upside Unlimited on April 5th of 2023. This is just one of many perks you’d get as a paid subscriber (with even more valuable content in the works as we speak)… if receiving curated scans to never miss a beat in the market is something that interests you, I highly recommend upgrading below:

Let’s get into some charts.

Stock #1: ANF

I got shaken out on the HVC undercut on weakness for the stock to rip higher over next couple of weeks. Next opportunity was 20EMA after gap up strength. Even stronger run now holding above 10EMA. More thoughts on chart.

Stock #2: CELH

Not been an easy trade by any means but finished the day above yesterday's HVC. All in all impressive action over past couple of months, this name is under big time accumulation.

I tried to trade this early last week through $150 and was stopped out minutes later under $145. Few sessions after we see undercut of 50DMA which acted as perfect shakeout prior to EPS.

Stock #3: ELF

This is the first name in my time as a trader to gap up 4x consecutively. Not many of these around so important to study from them and use to model future life-changing moves. With the right amount of capital invested in this name at the right time, easy life changer.

Most important thing to highlight in the chart below is the move always began with a gap up, then the gap up day close (HVC) was tested and held. This is edge!

Stock #4: FRSH

IPO starting to round out a bottom. Looking for average volume to step up & price action to continue to mature over next couple of weeks/months. Plotted HVC here as think this is level to be focused on (along with $20 whole number) if we see 50DMA test in gen markets.

Stock #5: MMYT

New name for me under ridiculous accumulation. Hard to ignore the volume bars on the bottom after EPS report. Sign of strength -- didn't even test HVC day two, gapped and went higher and made everyone chase price up.

Stock #6: UPWK

Was a good winner for me early '21, have used the business quite a bit over past two years and have had good experiences. Note HVC acting as resistance after HVE gap up. Highest Volume Ever makes this a must-watch for me going forwards.

Stock #7: VRT

Got bought up off the 10EMA, buyers stepped in right where they should for a strong stock. Looking to see if a bigger pattern can build out over next couple of weeks above the $30 spot on weakness or HVC + $35 on strength.

My Focus Names: VRT & UPWK

I won’t be trading tomorrow nor early next week to let the dust settle in the general markets but am watching VRT & UPWK closely to see if they offer a spot if/when market turns for a quick counter-rally.

I hope this has been helpful!

Greg

If you’re looking for more resources to level up your technical analysis in the stock market, look no further:

2020 Best Charts Book: https://gregduncan.gumroad.com/l/wmfsd

2021 Best Charts Book: https://gregduncan.gumroad.com/l/2021

2022 Best Charts Book: https://gregduncan.gumroad.com/l/2022

Earnings Gap Up Mastery Free Email Course: https://upsideunlimited.com/earnings-gap-course

Consider Becoming A Paid Upside Unlimited Subscriber: https://upsideunlimited.com/sub