A Multi-Step Process To Mastering Routines

Without a solidified routine, your results will NEVER be consistent

Contrary to popular belief, you don’t have to spend hours glued to your screens after the market closes on the weekdays or on the weekends to feel prepped & ready to trade the next session. To be a successful trader, you must find the perfect balance between working hard and taking time away to rest, recover, and refresh.

I’ve spent a lot of time over the past couple of years building and optimizing a daily & weekend routine system to do just that.

Let’s hop in:

Earnings Season is upon us — this is one of the most exciting times to trade IF you have a strategy centered around capturing momentum from Earnings Gap Ups (EGUs).

I’ve broken down every piece of my EGU strategy into a FREE 5-day Educational Email Course, which you can get immediate access to here:

Daily Routine

My Daily Routine is broken into 3 separate pieces: Premarket, During Market, and Post Market.

Here’s every piece of my premarket routine:

Premarket (30 minutes)

Answer Key Premarket Questions (3-2-3 Method)*

Scan premarket action on current positions (if I have any)

Check Futures for Key Levels, Set Alerts on SPY, QQQ, IWM, IWO

Finalize Focus List Alerts & Set Any Necessary Orders

*Key Premarket Questions to Answer (As Part of the 3-2-3 Method):

What could hold me back today?

Here you want to be very clear with the consistent actions you’re trying to avoid. For me, this answer oftentimes is something like, “Trading setups that are outside of my system. I will only trade setups that are a part of my strategy.”

By acknowledging the mistake I consistently make, and actively saying I am going to avoid it for the day, I create a clear path forward during the session and provide some consistency in thought toward my actions during the upcoming session.

What are the best setups on my focus list?

The goal of this question is to provide yourself with mental structure (in an unstructured environment). You know what tickers to execute on based on the levels you laid out in your post-market routine the day before.

Are there outside life factors affecting my ability to perform today?

This is the most important question of your new premarket routine.

Are you fighting with a significant other? Are your pets sick? Are there other areas of strife that may affect your decision-making today?

The answer to this question will be a clear indication of whether or not you’re in the mindset to trade.

During Market Routine:

During Market

Trade first 1 hour (Focus List Names ONLY)

Take Extensive Notes On The Action (3-2-3 Method)*

Check Back Last Hour or When Alerts Trigger

Taking Extensive Notes On The Action (3-2-3 Method)

Actions

One of the biggest improvements to my trading began when I started to write down my trading executions & associated thoughts during the session.

This allows me to accurately capture the exact emotions and thought processes I was working through as I put real money on the line.

Other Thoughts Based on Feel (Intuition Checks)

This section allows you to write down your thoughts about the overall activity of the market.

On a broad basis, are stocks participating in the day’s action? What are the indexes telling you? What groups is money flowing into?

By consistently checking your intuition vs. what the market actually does, you are able to build better mental models toward the patterns the market shows on a daily basis.

There will be a time when the market feels exactly like the previous day–now you have the ability to go back and check your thoughts that day & use them to your advantage in the present.

Post Market:

My post-market routine takes me about 1 hour on the weekdays. Here’s the overview:

Post Market: (1 hour)

Scans*

Journal Review (3-2-3 Method)*

WL Reviews

Go through each watchlist I track (Gap Ups, IPOs, ShortStroke Names)

Create Focus List Based on Scans/WL Reviews

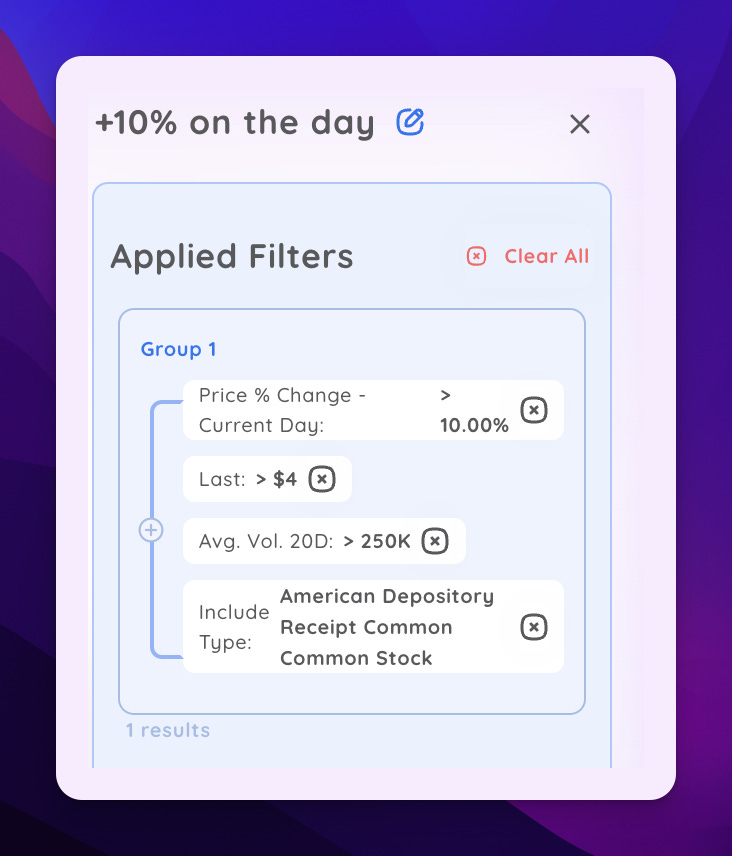

*Key Scans I run Nightly:

High Volume Names

Liquidity Volume

10% On The Session

*Key Nightly Journal Review Questions

Standout Names/Groups

This is where your scanning during/after the session gets put on to paper.

You are organizing your plan of attack for the upcoming session.

Here are some questions to ask yourself:

What are the best stocks/groups that deserve your attention going forwards? Do a couple of names stand out above the rest?

Final Thoughts About the Market’s Action

In this section, you can check your intuition notes from earlier or come up with conclusions about what the action is telling you for the days to come.

This is your brain dump section.

Areas of Success/Failure

Always make sure to look back on the day and grade your performance.

What did you do well today? What could you have done better?

Answering these two questions will provide you with valuable information about the thought processes and actions you need to take in the upcoming session to be the best trader you can be.

Weekend Routine (Total Time 2 Hours)

Now that we’ve taken a deep dive into my daily routine, here’s an outline for you to steal for your weekend routines:

Post Trade Analysis via Tradersync (1hr - Saturday)*

Review Notes from Week In Journal (30 min - Saturday)

Scans (1 hr total)*

Add names to WLs based on scans (30 min)

Run through WLs again to create a focus list (10 min)

A deeper look into the weekend routine structure:

Keep reading with a 7-day free trial

Subscribe to Upside Unlimited to keep reading this post and get 7 days of free access to the full post archives.