An Updated Look At My Positions

& what I'm focused on tomorrow

Today at a glance:

My Current Positions

Market Outlook

Focus List

I usually would send this out to paid subs only, but sending it out to everyone today!

If you’d like to receive this type of commentary/review multiple times throughout the week, consider upgrading to a Paid Subscription of Upside Unlimited:

My Current Positions:

100% cash! I sold NVDA, TSLA, META, and AAPL at the close today. Why?

NVDA pictured below — to me this is wedging up big time. Managed to close above 50DMA today but I am not a fan of the pattern, would rather be out than in here personally. If confirms out of Inside Day to upside tomorrow can revisit and say my analysis was wrong.

TSLA same deal here, kinda wedging up but sets up inside for tomorrow on low volume. Technically nothing wrong but I dunno my feelers just say step back. If this triggers higher tomorrow can always buy back, no issue doing that.

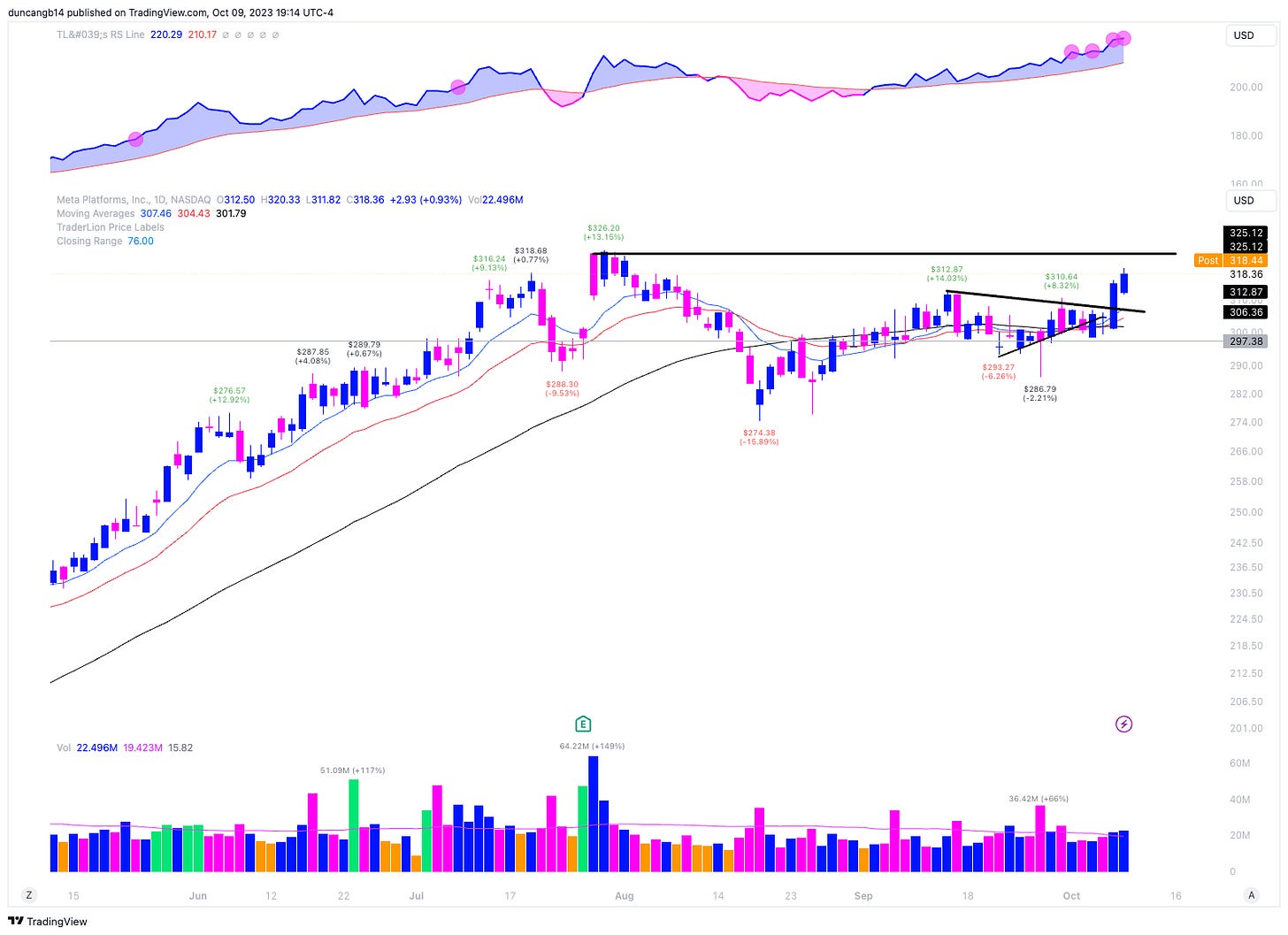

META love everything about how this name is acting and probably could have just set stops to even + let ride. Nothing wrong here.

AAPL decided to kick this out on a low volume rally into the declining 50DMA. Rest would make sense here, swing was good for about 1.5R. Secondary sell would be to that unfilled gap down area which has acted as resistance 2x now.

As we prep for earnings, I highly recommend going through this 5-day email course I’ve created sharing everything I know about trading high volume gap ups. It’s completely free and filled with tons of useful info:

Overall Market View

SPX held that $4215 spot on Friday last week and then ripped higher on volume. Low volume move higher today into the declining 20EMA. Some chop is expected. We’re also sitting right at that 4335/4340 prior support, looking to see if this confirms resistance tomorrow. If we move through 20EMA + this area, the unfilled gap would be next logical spot to get to and rest at.

QQQ makes it through the unfilled gap and finds support near the 10EMA this morning. We’re at the 8/29 ignite bar low, want to see if this acts as resistance here. 50DMA next logical spot to tag before some back filling.

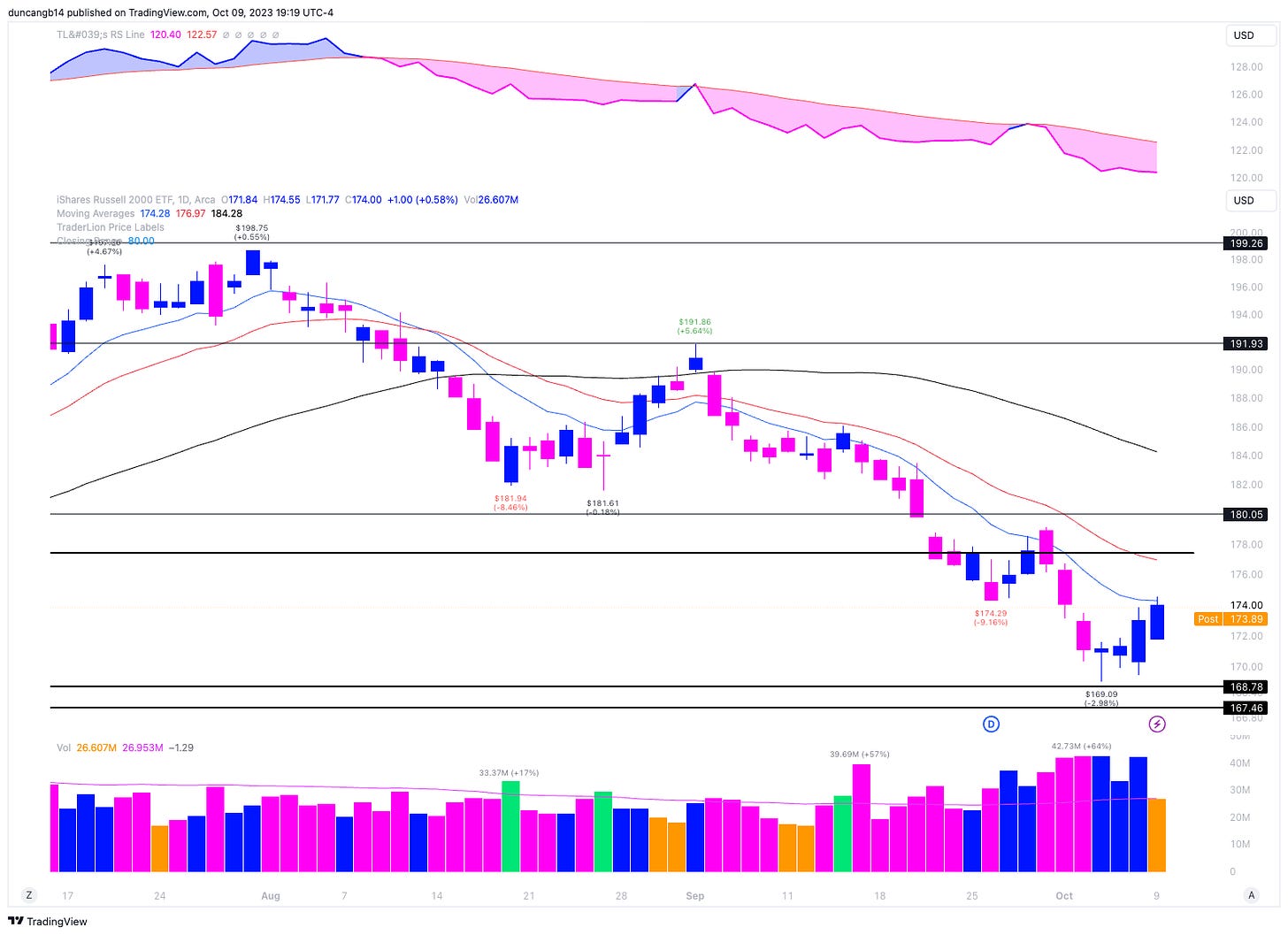

IWM so far this looks like a weak rally into the 10EMA, but there has been a legit pickup in volume so possible we’re seeing some form of capitulation in this index.

Focus List + Thoughts Into Tomorrow

Overall I’m more interested in earnings plays than the traditional liquid stuff. Feels like I’m putting in major effort to make a couple of %, and that’s not the environment I want to be aggressive in.

With that being said, here’s myFocus List heading into tomorrow:

AMZN: Been weak, looking to see if we breakdown here & 10EMA acts as resistance

IONQ: RS line lacking, price drifting higher on low volume. Unable to close above 10EMA. Break the 14.17 lows and think this thing has room to 12.5 on the downside.

TSLA: As I said in the chart above, could go either way here. Will play it as it lays.

NVDA: Same feeling, could go either way. See which way it breaks from here and play it accordingly on my end

Hope you’ve been well and caught a little of this 2 day move,

Greg

Other ways my work can help you become a better trader:

2020 Best Charts: https://gregduncan.gumroad.com/l/wmfsd

2021 Best Charts: https://gregduncan.gumroad.com/l/2021

2022 Best Charts: https://gregduncan.gumroad.com/l/2022