Assessing The Current Environment & Top Stocks To Watch For Monday

Assessing the market and the 13 names on my wider focus list

Today at a glance:

How my weekend routine shapes my market outlook

Analysis of the current market indexes

Top stocks on my watchlist for Monday

Let’s dive in!

Scrolling through Twitter/X this weekend has me perplexed.

On the one hand, there are a ton of bearish opinions that seem to have validity, backed by seasonality data, market breadth, etc.

On the other hand, there are a decent amount of bullish opinions that also seem to have validity, showing key levels of support holding on major names or how everyone’s bearish so they’re bullish.

When this is the case (and really any other time for that matter), I spend less and less time on socials and more and more time hitting the charts. At the end of the day, my weekend routine will tell me all I need to know about the current state of the market and its leadership.

So, here’s what price is telling me:

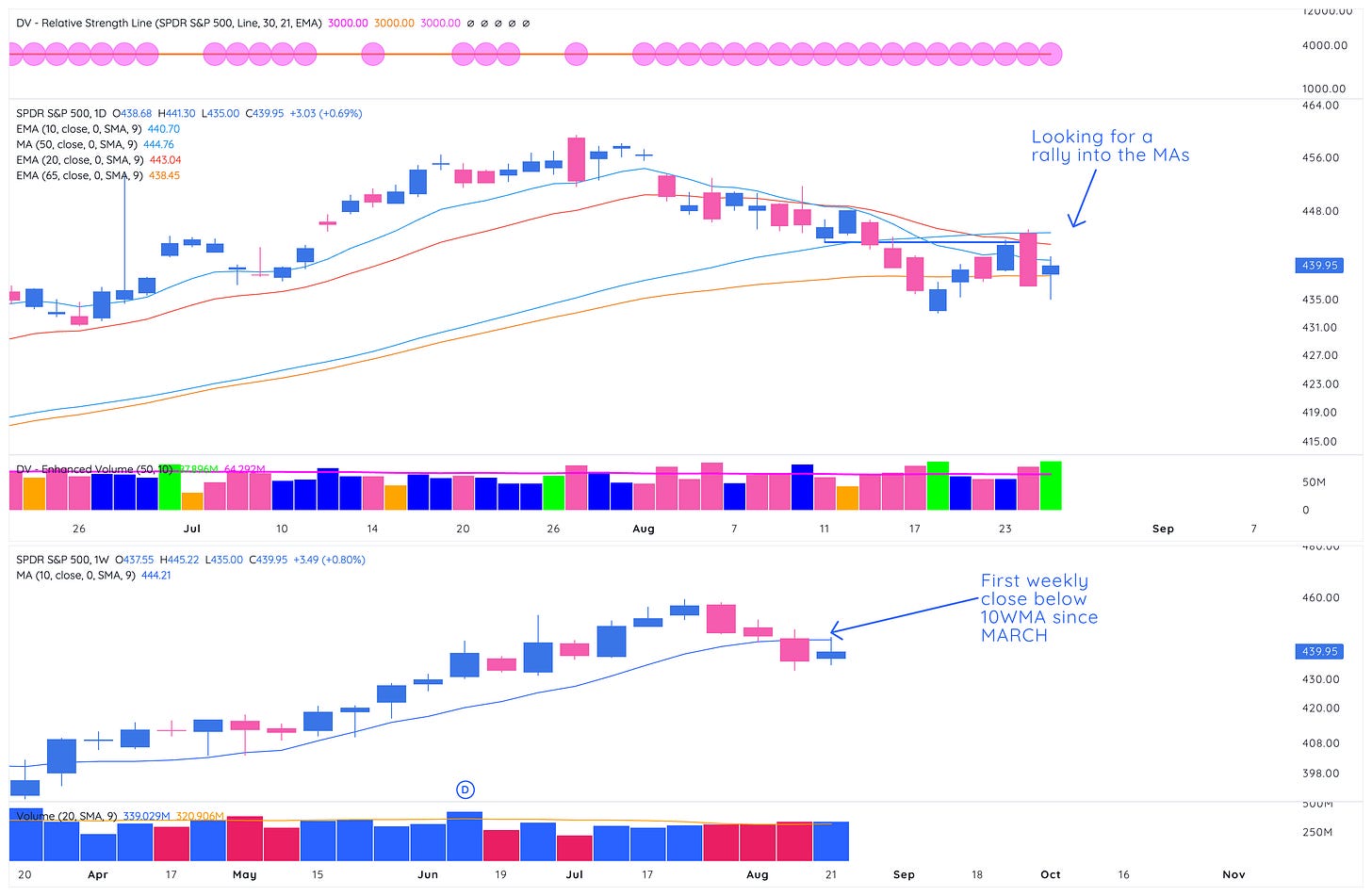

QQQ: We’re stuck in a range between $355 and $372.5. Those levels should act as good downside and upside targets if trying to play in the chop (which is not easy), a break above or below either one may have more important implications for the general market trend… but, until then, we have downtrending MAs above us that need to be cleared.

Another point to note is that the 10-week MA acted as resistance last week (note the lower weekly chart), so we have yet another area of extra emphasis.

SPY — pretty much same deal as QQQ, we need to see upside MAs reclaimed if any multi-week rally attempt hits us near term.

Note the weekly now registering two distinct closes below the 10-week MA in a row, which hasn’t happened since the first couple weeks of March.

When I look at the action outlined above, I’m not viewing the market as incredibly bullish. What I do want to see is how my focus list is holding up, which we’ll get into below:

Keep reading with a 7-day free trial

Subscribe to Upside Unlimited to keep reading this post and get 7 days of free access to the full post archives.