Can Your Trading Strategy Fit On A Single Sheet Of Paper?

Today at a glance:

Creating A Trading Blueprint In The Eyes Of A Market Wizard

5 Key Pillars To Cover In A Trading Blueprint

My Own Blueprint With The HVC System

Let’s dive in ↓

“If you fail to plan, you are planning to fail.” - Oliver Kell

When a US Investing Champion speaks, I listen. A little over two weeks ago, USIC Record Holder Oliver Kell held a webinar covering his 10 Trading Principles.

I’ve distilled my takeaways on each of the principles he shared in a thread on X here, but one topic I wanted to take a deeper look at today was how important having a trading blueprint is and how to create one of your own.

Here’s Oliver talking about just that:

What Is A Trading Blueprint & How Do I Create One?

I view a trading blueprint as my personal roadmap in the market. It's a single sheet of paper, but it's as vital as any trading tool I use. It's about distilling complex strategies into a simple, actionable plan & then getting out of the way.

To create your own trading blueprint, you start by defining your trading. It's a process of introspection and analysis.

Here's how you can tackle it:

Your Edge: This is the repeatable pattern that comes up on your screens, catches your eye, and leads to a trade having a higher chance of a particular outcome compared to another.

Your Entry Tactics: Entry tactics happen AFTER you’ve identified your edge on the charts. Where are you entering specifically? What other indicators are factoring in to your decision? What should you be looking for upon entry?

Your Risk Management Plan: What are your rules regarding position sizing? Max risk allowed on a trade? Total drawdown allowed to the account? Max Open Risk? Use of margin? All of these questions need to be clearly laid out so there’s no ambiguity when going to enter and exit trades. It's about defining your risk before you enter a trade, not after.

General Market Environment Factors: Your strategy might be brilliant on paper, but how does it fare in different market conditions? Bull markets, bear markets, or choppy sideways movement – your blueprint should adapt to the environment or specify when to stay on the sidelines.

Circuit Breakers To Deal With Psychology: Trading is as much a mental game as it is a strategic one. Here, list the 'circuit breakers' you'll have in place to prevent emotional decisions. This could include daily loss limits, cool-off periods, or specific actions you'll take if you notice you're trading based on emotion rather than your plan.

My Own Personal Trading Blueprint

After watching Oliver talk about the importance of a trading blueprint, I sat down and wrote out each piece of my own Earnings Gap Up strategy.

Let’s take a quick look at each part:

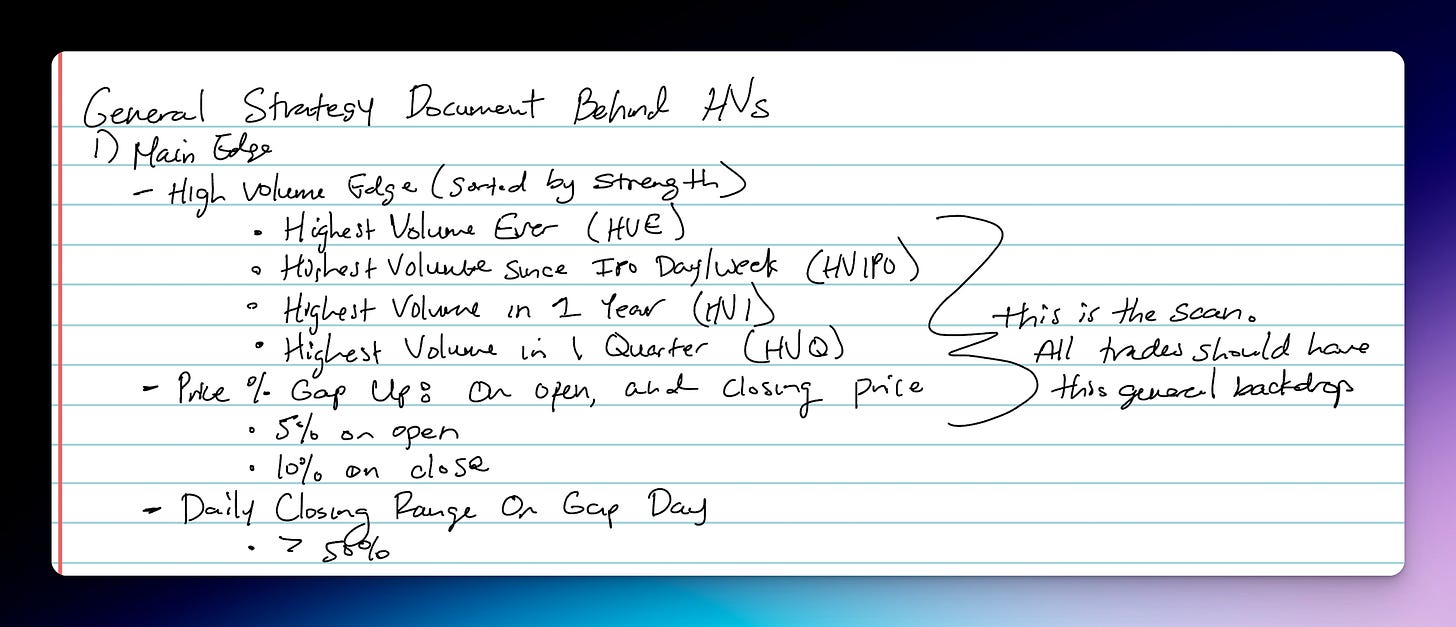

My Edge

These are the same high volume characteristics I’ve talked about so many times over the past couple of months.

High Volume Edge (Ever, Since IPO, In 1 Year, In Recent Quarter)

Price % Change On Gap Up > 10% (the higher the better)

Daily Closing Range > 50% (the higher the better)

The best part about this edge is I can create simple scans to catch and spot these moves, over and over again.

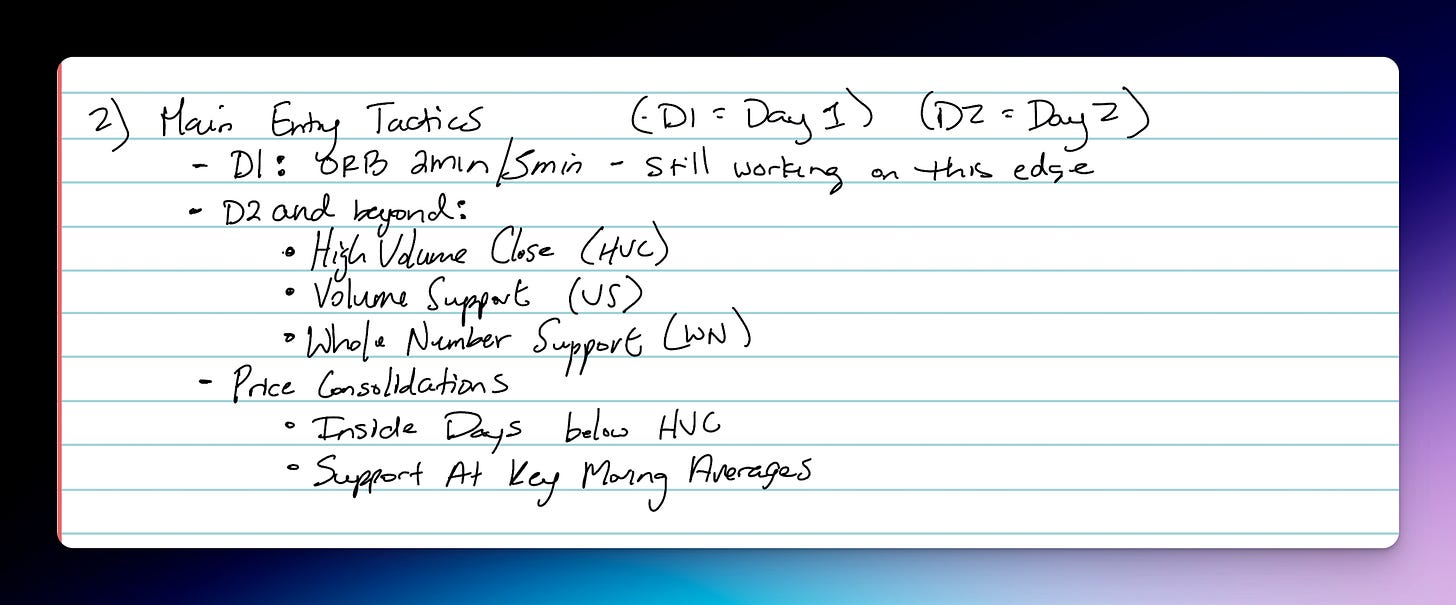

My Entry Tactics

This is the one piece of the strategy that I know will change and morph over time. I’m currently studying a couple of other ways to enter these trades to best skew the Risk:Reward ratio in my favor. But, in its current state, here are the key entry tactics:

Day 1: 2min/5min ORB along with VWAP

Day 2 & Beyond: High Volume Close, Volume Support, Whole Number Support

Price Consolidations After Gaps: Inside Days below HVC, Support At Key Moving Averages (4EMA, 10EMA, 20EMA)

Again, I’m trying to keep it as simple as possible while also giving myself enough opportunity to catch major winners of many shapes and sizes within the HVC edge.

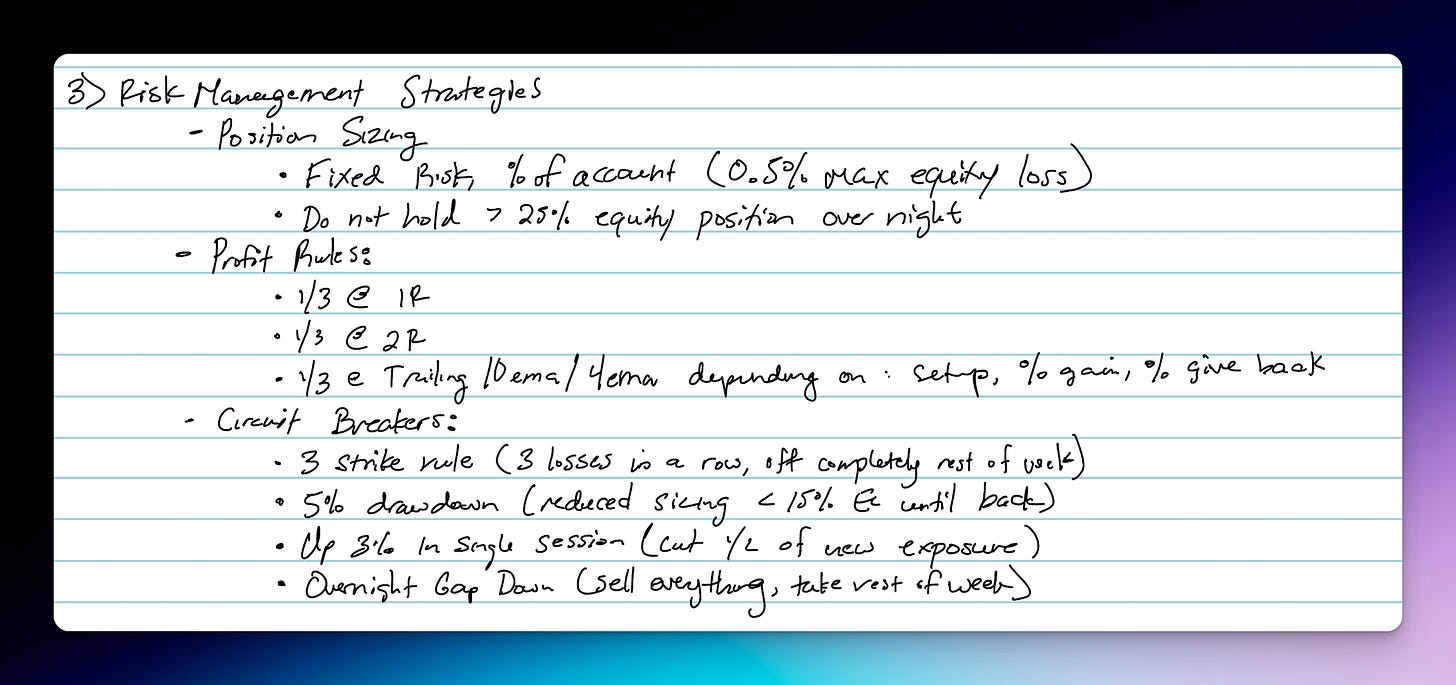

My Risk Management Plan & Circuit Breakers

I’ve combined two parts here — Risk Management & Circuit Breakers.

Risk Management:

Position Sizing & Fixed Loss Parameters

Profit Taking Rules On Strength

Circuit Breakers:

3 Strike Rule

5% Drawdown Rule

Up 3% Equity Or More In A Single Session

Overnight Gap Down Rule

These are key points of emphasis to keep myself in the game for the long term.

If there’s interest, I can dive into the specifics of the circuit breakers I’ve developed (just reply or comment letting me know if this is something that interests you)…

General Market Environment Plan

As I continue to study and refine my edge, I’ve realized that the best markets to trade Earnings Gap Ups are ones that are just coming out of correction, in which there is an explosion of breadth higher as the market reclaims key moving averages. These MAs are:

SPY & QQQ > 10 & 20EMAs

I’ve also recognized how correlated my positive performance is to positive action in the IWM. When this group of stocks does well, my strategy tends to perform positively.

Again, these are all findings that I will refine and hone in on as I gain more experience implementing what’s on the paper in real-time.

Bringing It All Together:

Your blueprint should be a living document, adjusting as you learn and grow as a trader. It's not about having all the answers right now, but about starting with a solid foundation that you can build upon.

I’m sure what I’ve written will change as I continue to study and refine my edge/entry tactics.

By crafting a personal trading blueprint, you’re not just planning trades, you're planning a trading career. It's a commitment to discipline, continuous learning, and respecting the markets.

And, when you really get into it, maybe you’ll add some key parameters around the daily/weekly routines you have in the market, how you’ll manage your time doing so, and where post trade analysis fits into your schedule.

Answering all of the above may not fit in 1 sheet exactly like Oliver said, but it definitely puts you ahead of 99% of others who don’t have a trading blueprint.

I hope you find some time and commit to this exercise before 2024 starts.

Greg

Other resources to study:

2020 Best Charts: https://gregduncan.gumroad.com/l/wmfsd

2021 Best Charts: https://gregduncan.gumroad.com/l/2021

2022 Best Charts: https://gregduncan.gumroad.com/l/2022

Earnings Gap Up Mastery Free Email Course: https://upsideunlimited.com/earnings-gap-course

Consider Becoming A Paid Upside Unlimited Subscriber: https://upsideunlimited.com/sub

Nice work, Greg. Very informative. You are an up and coming market wizard. Keep up the great work!

Good job Greg! About entering on the day 1, did you have more success or fails lately? I think that you have to consider the context of the stocks, for example if it is a stock with power gaps up and that this moves it to a new stage 2 the probability of success are higher. If it is a PEG on a late stage advance maybe it is better to wait for day 2. I bought your course, well made congrats!