How to Master an Edge: Deep Dive

Borrowed conviction doesn't make you money - mastering your edge does. Here's how...

Today at a glance:

Importance of mastering an edge as a trader

Deep dive into how to collect examples, mark up, and build conviction

Benefits of increased conviction

Applying this system to any new edge you want to master

Importance of mastering an edge as a trader

Trading on borrowed conviction is one of the main killers of a successful trading career.

By learning how to master your own edge, you unlock:

Higher conviction (leads to higher position sizes & better returns)

More emotional control (better execution, less hesitation)

A new level of intuition (knowing when setup will work & won’t!)

Here’s every step I take when I begin to master a new edge in the market:

Step 1: Collecting 1000s of Examples

I can’t overstate the importance of this step enough. Once you have an edge you want to study, you MUST start collecting examples.

To mark up charts like the market legends, focus on the following 2 things:

General market at the time the setup triggered (uptrending, downtrending, chop)

It’s important to know if the market environment was healthy enough to even trade the setup in the first place.

Specific price/volume/RS queues that would have led you to get this name on your Watchlists

Without having a specific process to get this name on your watchlist, you won’t be able to trade it in the future even if the setup meets your entry criteria.

Side note: one of the major benefits of having a massive database of examples is the ability to consistently look for precedents. The market doesn’t repeat, but it often rhymes. Hosting a large database will allow you to find precedents and be more prepared when a potential setup triggers.

Step 2: Marking Up Each of the Examples

Now that we’ve built a framework around collecting examples, it’s time to annotate and mark them up correctly.

When I find an example that is worthy of my historical database, here are the first two steps I take to mark the chart up:

Highlight the key triggers to get the name on the WL

Highlight the market environment at the time the setup triggered

Here’s where it gets really applicable:

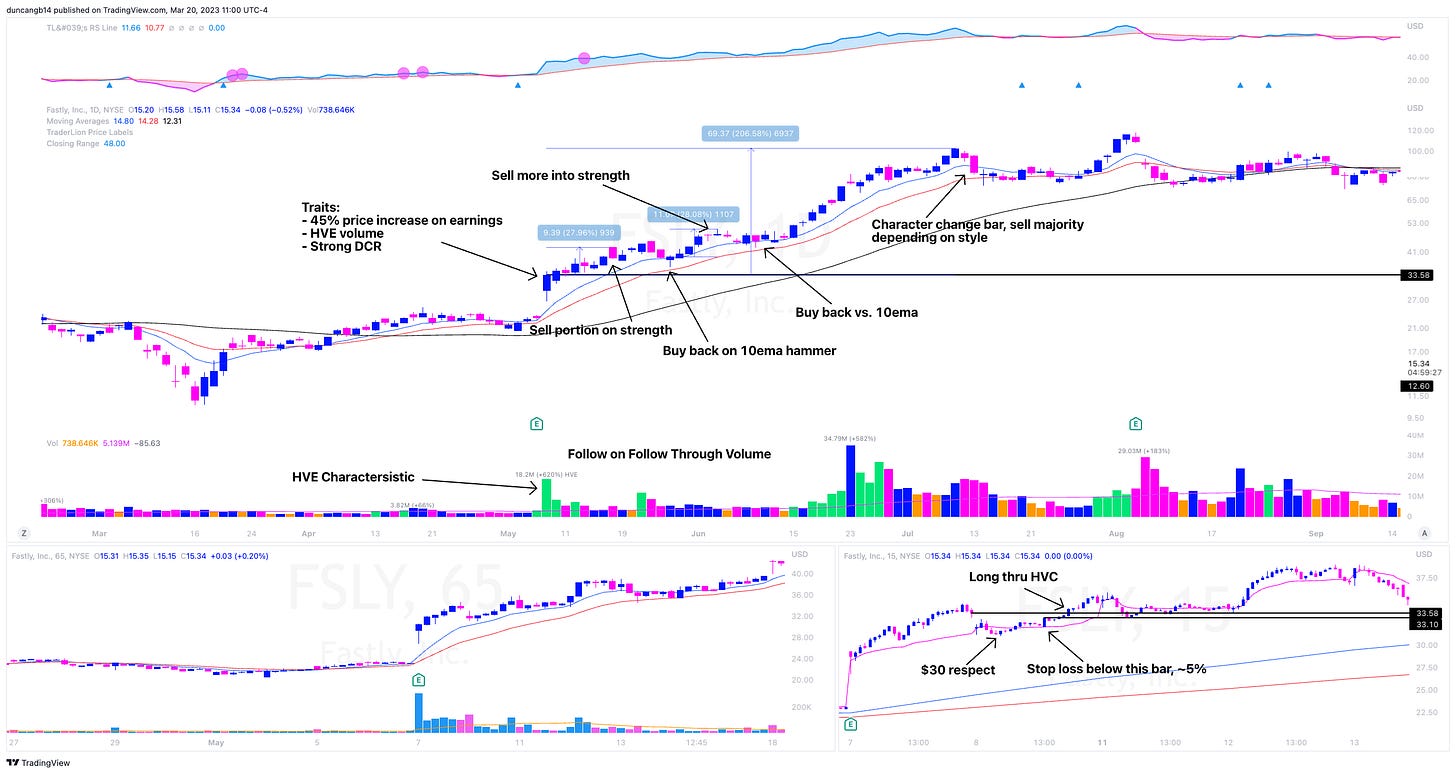

Mark up the specific buy/sell point upon entry

Highlight the % drawdown from entry to before the setup worked (build your expectations of what type of loss you could be looking at by trading the setup)

Highlight where you would sell on strength, reduce on weakness, and be out of the position entirely

Here’s an example from my archives: FSLY in 2020:

Pro Tip: Try to collect historical examples that still offer intraday data. I can go back a couple of years on TradingView and collect 5min data… this will help you visualize the emotions you would have been feeling as you put a trade on.

Pro Tip 2: I’ve found a lot of power in recording a video for myself as I walk through a historical trade example. I am better able to internalize patterns - which again will lead to increased conviction when the time comes to trade a new name. Maybe you can try this too and let me know how it works for you…

Step 3: Making Rules About What to Look for in the Future

Once we’ve marked up 1000s of examples, we can start to build a model book.

This model book will allow us to see the common patterns that the biggest winners you’ve collected have displayed and begin to look for those characteristics in the future.

In my HVC model book, I’ve categorized examples by:

Volume signatures (HVE, HVIPO, HVLE, HV1)

If I was to do this with base breakouts, I could categorize the examples by:

Volume % increase on breakout

Price % gain on the breakout day itself

% increase two weeks after the breakout

There are a million ways to categorize, but by doing this you can build rules around trading only the best variations of your setups. This is a little more advanced but definitely worth the effort.

If you’ve enjoyed this edition of Upside Unlimited, please consider leaving a like and comment below.

What You Learned This Week:

The 3 most important steps to mastering an edge & building conviction

A quick glimpse into how I do it

Some pro tips ;)

Final thoughts:

Mastering an edge in trading requires a systematic approach that involves collecting thousands of historical and present examples, marking up each example, and making detailed notes about what to look for in the future.

This process will lead to higher conviction, better emotional control, and a new level of intuition when it comes time to put your money to work.

Ultimately, the key to successful trading is having the conviction to stick to your edge, and this can only be achieved through a disciplined approach to mastering your edge.

Talk to you next week,

Greg

p.s: I’m currently working on a free High Volume Close email course! This will be an awesome resource and distill the key points you need to master this setup.

Sign up for the waitlist here (it will go live later this week):

First, I thank you and appreciate your interventions on Twitter and these articles. Coincidentally I have been thinking all these days that the learning method, at least in my case, should have as an initial part the deep study of large movements in charts in an exploratory way and then just define what type of setups I am interested in specializing in those movements. And just based on that, everything related to risk management and others. The point is that in this article you propose to start the study of graphics once you have already developed an edge and you know the setups you will focus. My request then, when you have time, and if you don't mind is what in your opinion are the steps to develop an edge that is a step prior to specializing in it. Thank you so much.

Thanks Greg based on what you said I started reading charts Bill O'Neil marked up. It was chrysler 1963. In the summer it pulled back 20% and was sold. One month later it was higher and he indicated buy. What is the mindset that that logically allows you to do that? Take a big gain 20% off its high and then come right back in and buy at a new high price?