Post Market Routine Walkthrough (In-Depth Video)

Recapping today's action post FOMC.

Today at a glance:

General market overview (SPY, QQQ, IWM, IWO)

[PAID] Strongest Focus Names

[PAID] Video Walkthrough of Tonight’s Entire Routine (20min)

Let’s dive in:

Hey there! Hope you’ve been able to avoid most of the market’s downside over the past couple of days.

As you all know (if you’re a paid subscriber), I’ve been reducing exposure as the feedback from my trades was negative (3 losses in a row, open profits diminished). This for me is usually a warning sign, and it played out to be exactly that to end last week.

Today’s action post FOMC confirmed the market’s weakness back to the downside after yesterday’s strong movement off the AM gap down. Let’s get into some charts:

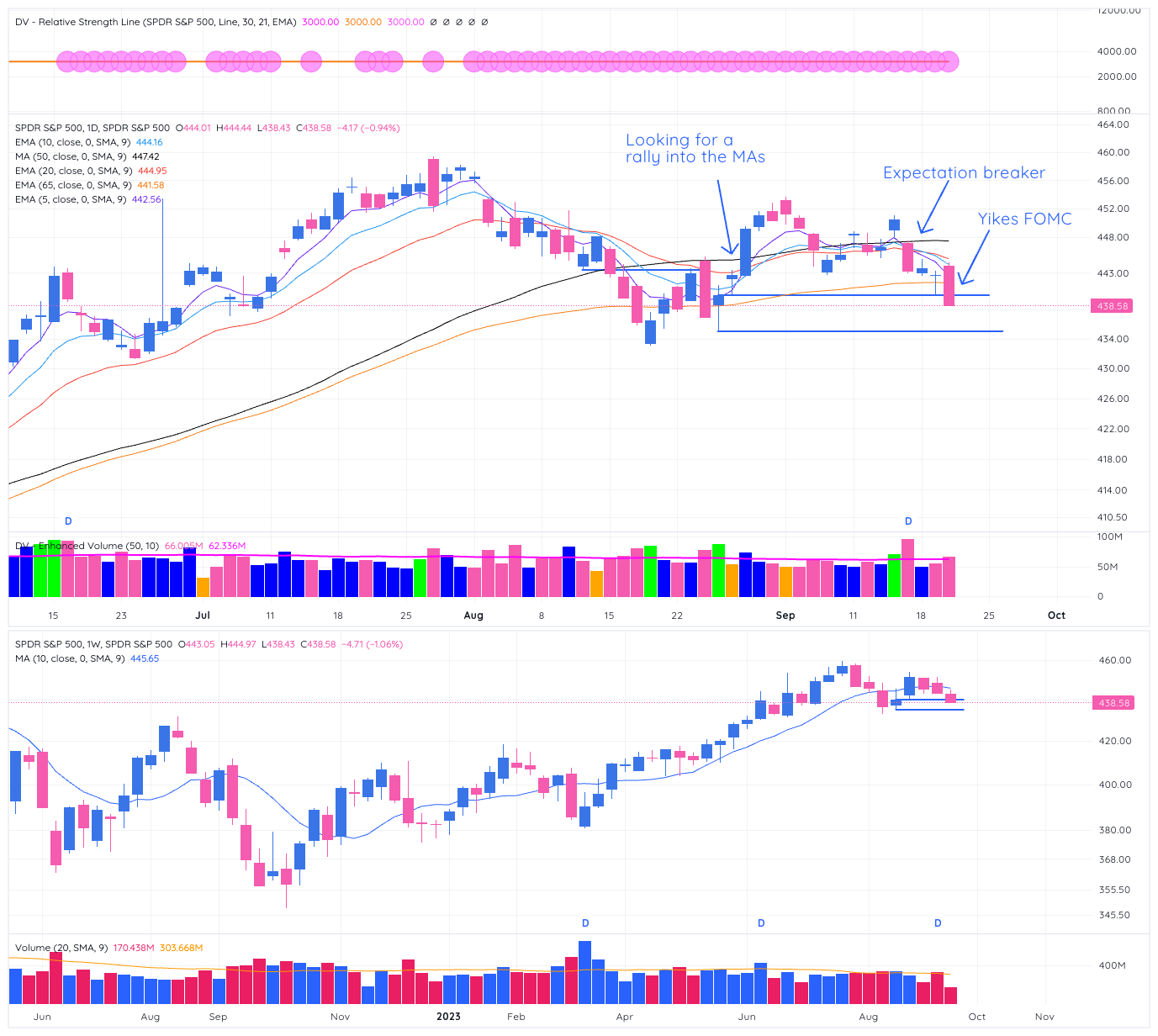

SPY:

Daily: Clear weakness and a follow through to the downside with today’s outside bearish engulfing bar. Not at all a fan of any upside here…

Weekly: 10-week SMA now turning negative, again see no reason to be aggressive when upside follow through is non-existent.

QQQ:

Daily: Much like spy, follow through to downside and today’s close below 65-ema. Still holding upside reversal close on 8/25, but would not be surprised for a gap down open below this level tomorrow (and then maybe a rally to close the week just to F with people ;) )

IWM:

We’ll see what happens here but we have an unfilled gap up in the 176-178 range, would not be surprised to see this fill before we get some sort of relief rally. Weekly looks like a classic short into the declining 10weekMA (everything is always so easy in hindsight!)…

IWO:

Now into the gap, we’ll see if we can rally if/once we close it over next couple of sessions.

Strongest Names To Keep Track Of:

Keep reading with a 7-day free trial

Subscribe to Upside Unlimited to keep reading this post and get 7 days of free access to the full post archives.