Recapping the FED Day + Volatile Action

and what I'm looking to trade the rest of the week...

For all of the index / ETF charts you see below, the bottom pane is “Webby’s RSI” which stands for Mike Webster’s Really Simple Indicator. This plots a graph of the percentage difference between the day’s low and the 21EMA. The Green line is the 2% above line, black is 4% above line, and red is 6% above line. Generally, the market is in a healthy uptrend when in between the 0-2% range, and then is overheated when we get above the 4% line (note that we can get multiple sessions above the green line if go back and study history…).

Market Review:

SPX Review: After some midday selling around 2PM, the SPX fought back and closed just above positive on the day. The action tomorrow will be much more telling than what we saw to end today’s session, and positively there are a ton of stock setting up in great spots (I’ll cover this in the FL later). SPX living right at that 2% Webby RSI line which is constructive & powerful, nothing worrisome to see here yet on this index.

QQQ Review: Impressive bounce off of the 10EMA - one that was very buyable if ready. Tech continues to act incredibly well and this is seen by the near 4% rating in Webby RSI today… sideways consolidation would be healthy while rotation into SPX / IWM takes place over the next two days. We’ll see how it plays out.

IWM Review: Holding the important low of $184.31 which was Tuesday of last week. Note that Webby RSI is within healthy ranges, just below the 2% extension. Again, would like to see rotation here as QQQ consolidates…

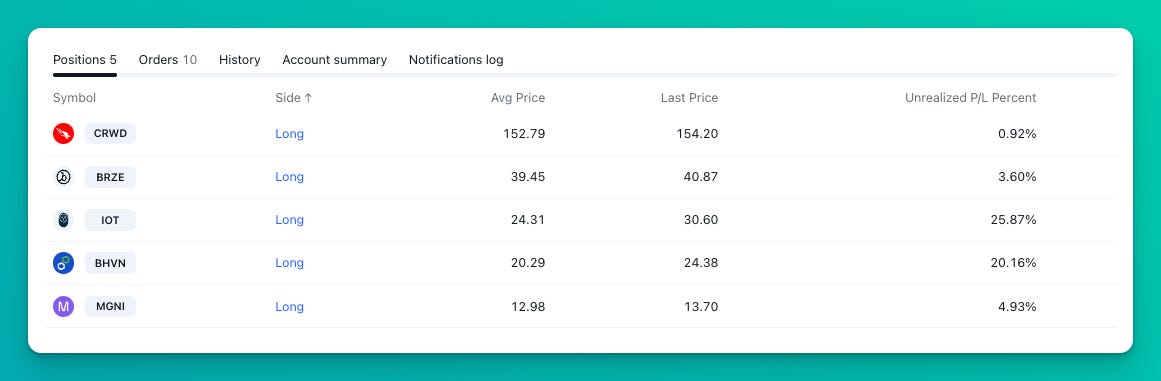

Positions Review:

Sold DBI today for a net 2.5% gain, this was a 10% gain yesterday that got slapped today. Won’t revisit.

Also sold YEXT after holding that, already have enough risk on with new position in CRWD so will set buy stops for tomorrow through HVC and see how things play out.

Overall am up 4.5% on the month with reduced position sizing, looking to get more aggressive as the account builds a cushion and I reclaim drawdown/YTD highs (about 1% equity away from that now).

On to the focus list:

Focus List Review:

Keep reading with a 7-day free trial

Subscribe to Upside Unlimited to keep reading this post and get 7 days of free access to the full post archives.