Reflection

As 2022 comes to an end, I hope you all are well.

Most importantly, I encourage you to spend time this holiday weekend reflecting.

I’ve done a lot of that this week, which leads me to this question -

Among the various responses, these stood out the most:

and…

plus…

I loved these responses because they are rooted in two main concepts (which apply to any profession in life):

1. Appreciation for the process

Every up and down is part of the process of becoming a great trader.

Without the downs, the ups wouldn’t feel so good. And without the ups - well, we have to cling on to something to keep us going. 😅

2. Success is a long road

Many traders think success should be quick in the market. This clearly isn’t the case, and anything good in life takes time.

If we can embody these two principles, and apply them daily, we are guaranteed to be on the right path.

So as we wrap up 2022, ask yourself the same question:

If you could restart and do something differently, would you?

Or — would you continue on, appreciating the ups and downs and understanding that your journey to success is long and worth it…

Reflecting on this week’s action in the market:

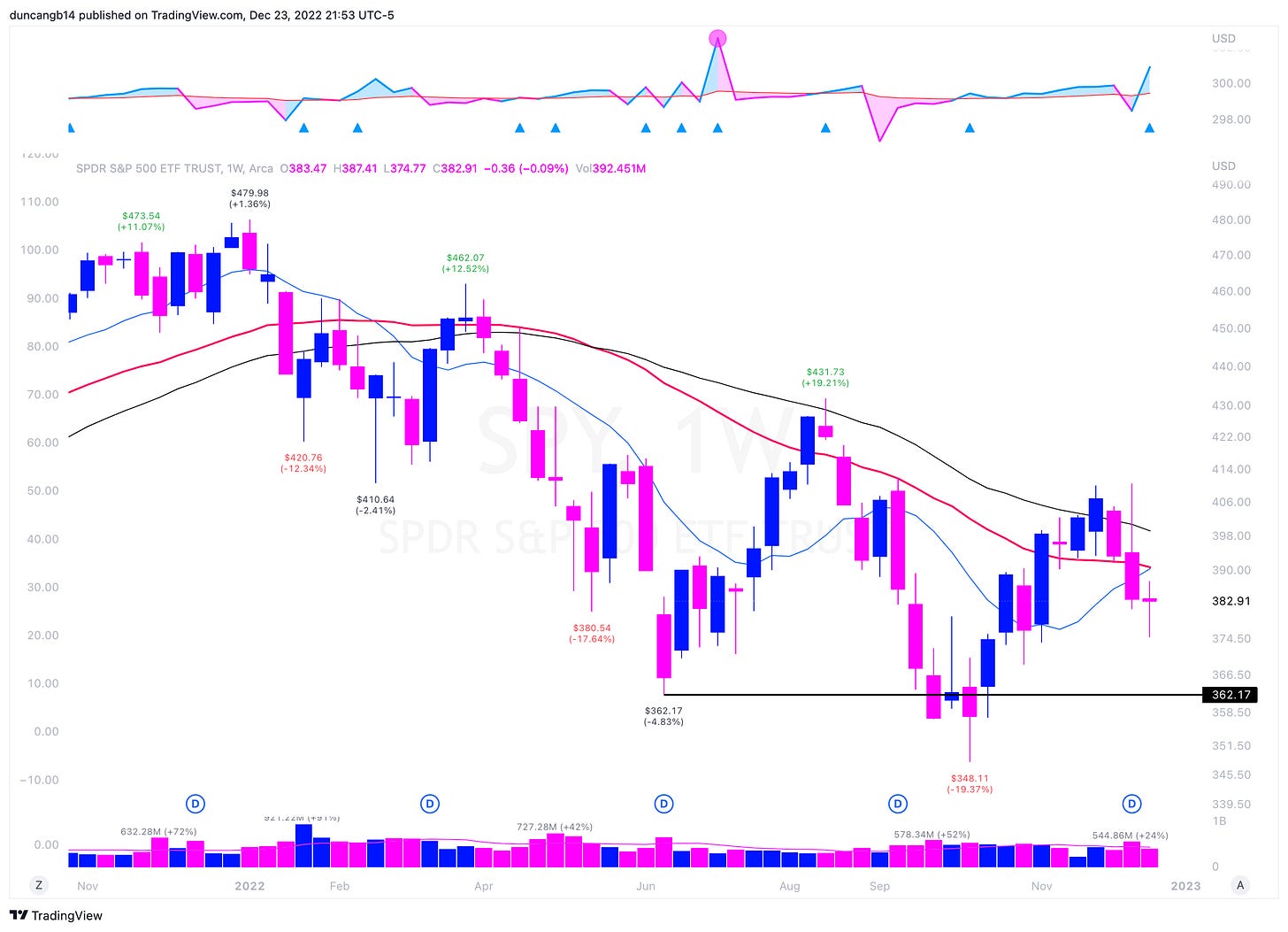

This week was action was muted on the SPY, finishing the week -0.09%.

To keep it quick, I wanted to cover two names that stood out to me this week.

Viking Therapeutics (VKTX)

The highest volume ever gap up was our clue to put this on the watch list. The day after, we see a swift move through the High Volume Close (HVC), which acts as a potential entry point.

At that time a potential stop loss would have been the low of day, which was a little under -6%.

The upside in this name was 20% in 4 sessions (so far), which is over 3x the initial risk.

Madrigal Pharmaceuticals (MDGL)

This pattern was nearly the exact same.

Using the HVC entry tactic, there was potential for a near 35% gain in only 3 sessions.

The lesson?

You can find setups even in bear markets, you just have to know what to look for.

You always have to make sure the potential reward outweighs the risks (and make sure your risk is managed!).

That’ll do it for this week.

Hope you found some value and give yourself time to reflect on everything 2022 had to offer.

DISCLAIMER:

For educational purposes only. Financial products involve significant risk and potential for substantial loss. Nothing included in this newsletter is investment advice or a recommendation to buy or sell any securities. Past performance is not indicative of future performance.

Thanks for reading my first-ever publication. I’d love it if you stuck around & became a part of the Stocks & Wealth community.