Rising Wedge - A Common Pattern Right Now

Reviewing the rising wedge pattern & 3 big names showing this action

Today at a glance:

Reviewing The Rising Wedge Pattern

3 Examples & Expected Outcomes

What To Think Going Forwards

Let’s get into it:

My favorite short pattern is the Rising Wedge.

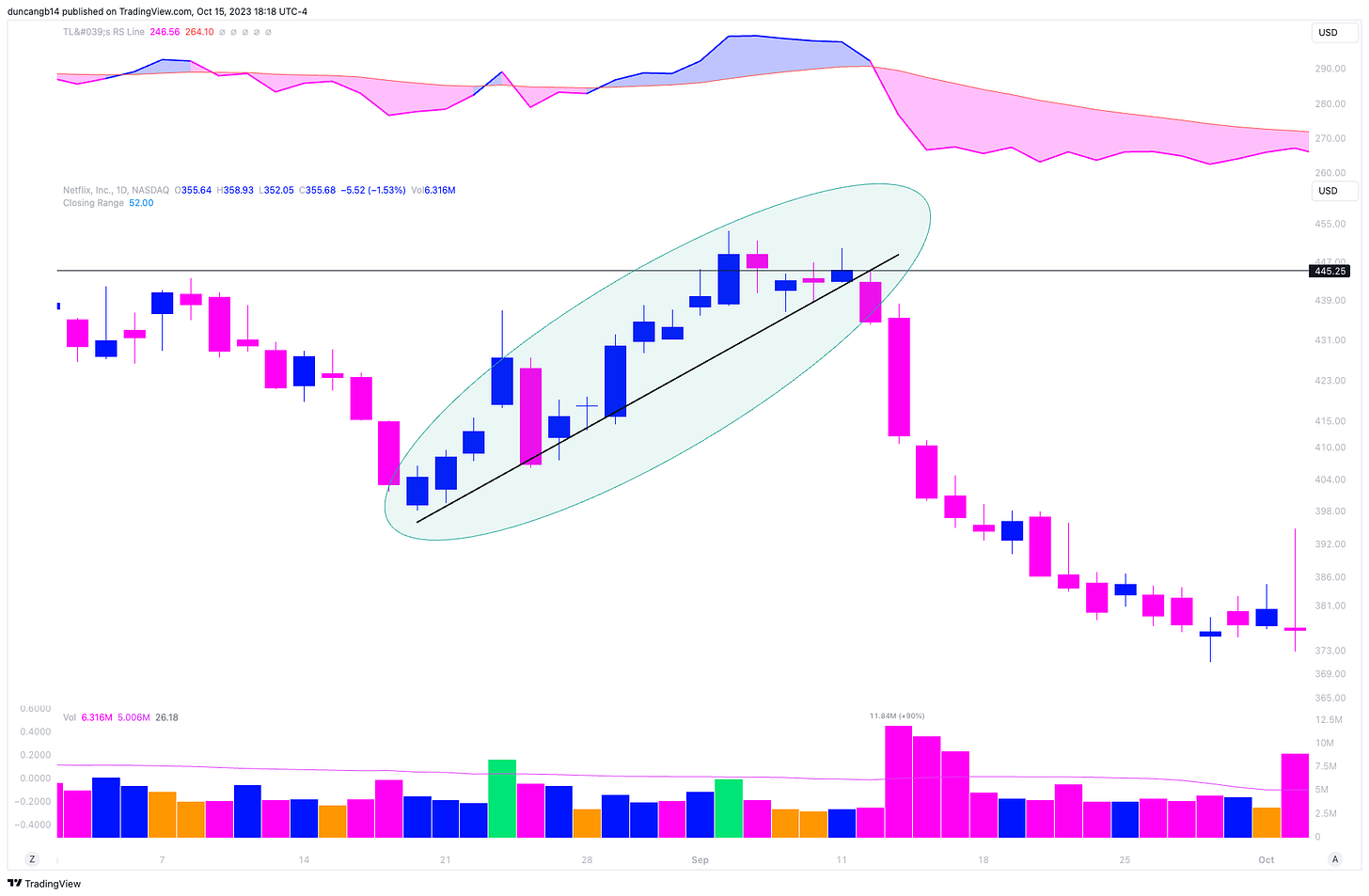

Pictured above: NFLX breaking down from a rising wedge pattern, netting a 15% down move in only 2 weeks.

One of the main lessons I had from 2021-2022 was to be able to spot short patterns playing out in real time even if I had a bullish bias on the market. Every weekend I try to spot these patterns on leaders and laggards alike.

This will help continue to train my eye for when I am ready to short & also recognize when my current long positions have the potential to see a trend change to the downside.

There are 3 examples I’m focused on right now:

NVDA

Price trading right down to the upwards sloped trendline, highlighting the wedging up pattern no bull wants to see.

The question is — do we break down from here or find support? Based on how the rest of the market looks, I wouldn’t be surprised to see a continuation to the downside.

One positive on this name is the RS line continues to trade above the 21EMA, which has been a positive sign all of ‘23.

TSLA

Two sessions ahead of NVDA here as it has already broken below its wedging up trendline. Major confluence of warning signs here as the RS line breaks its 21EMA as well.

Bigger picture the Tuesday wick seems to have been a ‘lower high’ when compared to action in September. All that’s left to see now is bottomside support at $237 for a ‘higher low’.

We’ll see, have no position here.

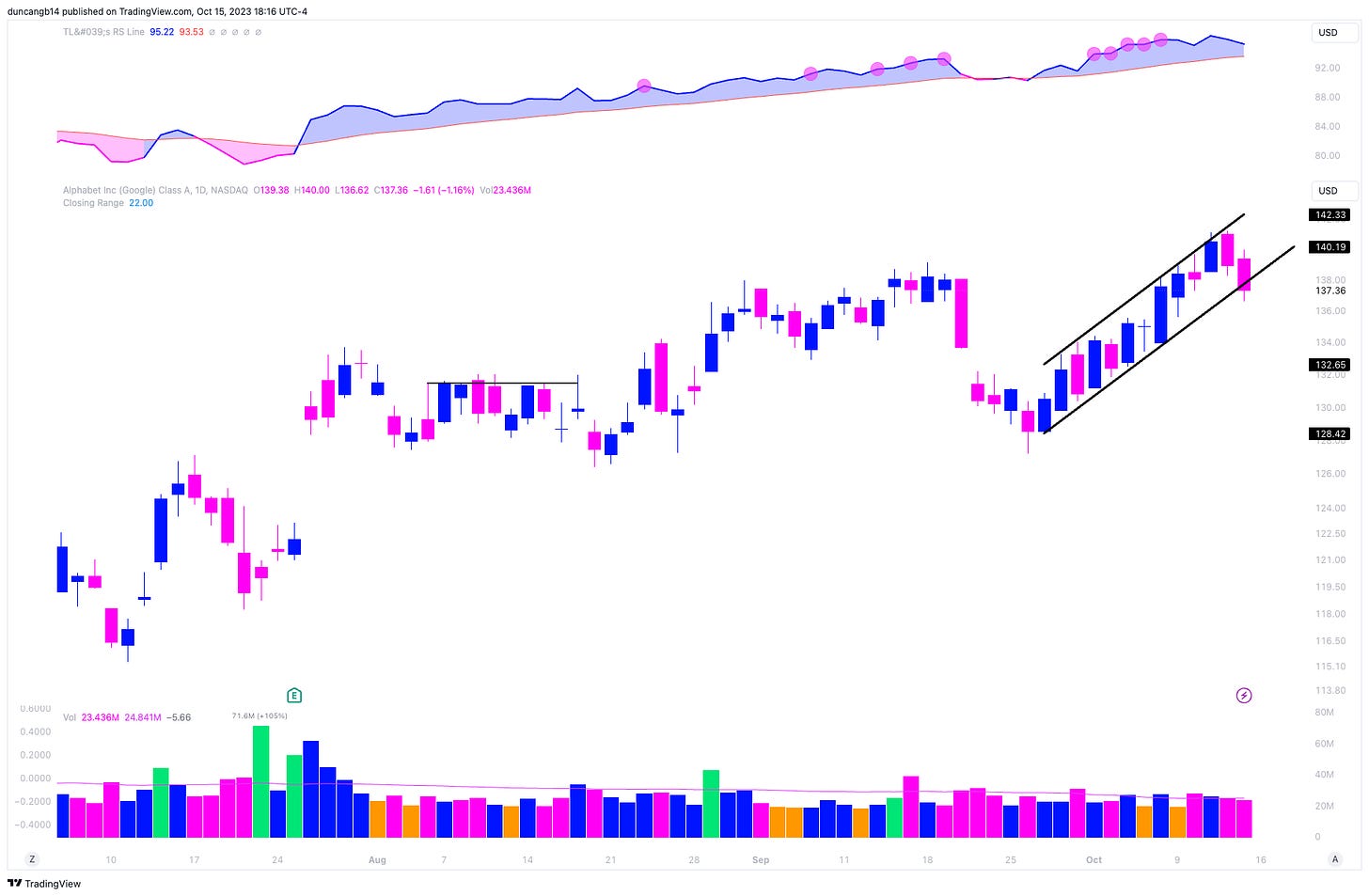

GOOGL

‘Frozen Rope’ type pattern here as it continues to wedge up between the upper channel and lower channel.

Friday’s price closing just below the lower channel is a sign of worry for the bull case as we also stall at highs. One positive is the RS line remains above the 21EMA.

Market Views Going Forwards

Last week, I sent out this tweet:

To keep it simple, I am solely focused on this playbook as Earnings Season begins.

If you aren’t quite sure how to approach or trade an earnings gap up, I highly recommend checking out my free, 5-day email course. 5 lessons, 5 days, and a new setup to add to your arsenal with a ton of examples.

SPY & QQQ aren’t in terrible shape, but there isn’t a ton out there in terms of tight setups to the long side. We’ll see if the downside can resume early in the week, or if there’s a fight from the bulls and further chart tightening.

In any case, you should be looking to gauge the health of the market through an earnings gap up lens. If they hold, it’s likely risk is on from institutions. If they don’t, watch out!

Talk soon & good luck this week,

Greg

Other resources to study:

2020 Best Charts: https://gregduncan.gumroad.com/l/wmfsd

2021 Best Charts: https://gregduncan.gumroad.com/l/2021

2022 Best Charts: https://gregduncan.gumroad.com/l/2022

Earnings Gap Up Mastery Free Email Course: https://upsideunlimited.com/earnings-gap-course

Consider Becoming A Paid Upside Unlimited Subscriber: https://upsideunlimited.com/sub