Scan of the Week #15: Double Inside Days

Catching momentum at the right time...

An “Inside Day” in the market is when today’s bar is entirely inside yesterday’s bar. This pattern shows rest after a strong move and can be powerful to track when looking for continuations to the upside.

We can take the Inside Day setup one step further though and begin to look for a Double Inside Day, which is characterized as today’s bar being completely inside of yesterday’s bar, and yesterday’s bar being completely within the bar of two sessions ago.

Here’s a visual using SMH:

This is a powerful structure to learn how to spot and scan for, and when coupled with other criteria you can stumble upon high quality setups. Here’s the exact scan I use to track Double Inside Days:

Key Criteria:

% off 52-week High > -25%: The closer to highs the better. A lot of the strongest names currently are at new highs or within 25% of recent ones, so I want to make sure I’m tracking the Double Inside Day on these setups specifically.

Price vs. 10DMA: A good way to ensure you’re trading a strong trend is to make sure the stock in question is above its 10-Day MA.

Key Price & Volume Filters: In many of my screens I’m looking for stocks > $15 and trade an average 20D volume of > 500K shares. These are the simple filters that the best stocks I’ve traded have displayed before/during their massive runs.

Specific Entry/Exit Points Using the Double Inside Day:

Much like a traditional inside day setup, the traditional buy point is through the prior day’s high, and the stop loss is below yesterday’s low. The beauty of this setup is the tightness of price action allows you to manage risk and know quickly whether you’re right or wrong.

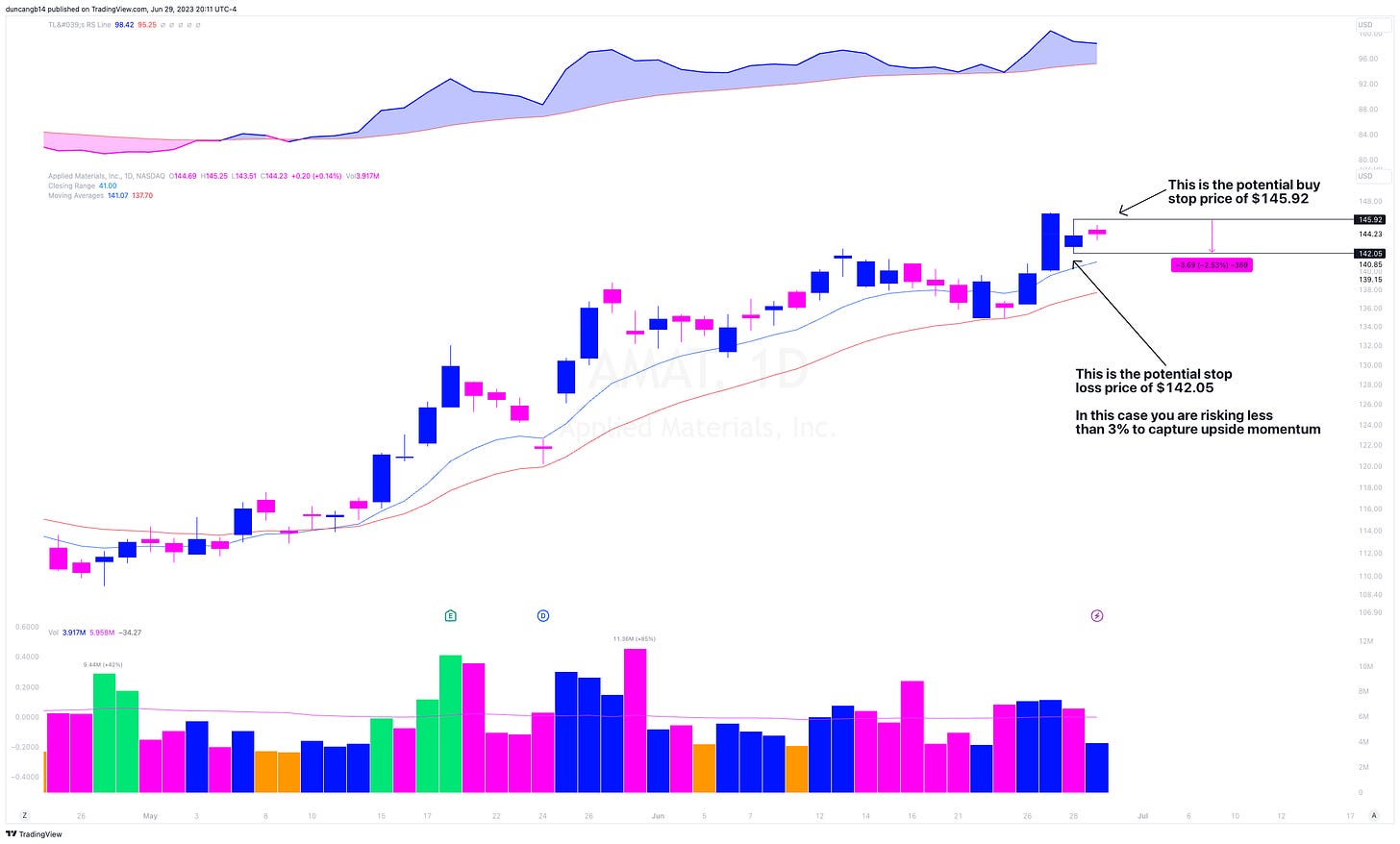

Here’s a markup of the potential buy/sell points I would use on AMAT:

This specific setup has been one I’ve been studying and slowly adding to my chart book with goals of implementation in 2024.

I regularly send out the Scan of The Week to my paid subscribers, this is the first edition that is being sent out to the public. If you enjoyed this and want access to more, consider becoming a paid subscriber here:

Standouts From Tonight’s Double Inside Day Scan:

AMAT: As marked up above, I’m watching AMAT for clues on the growth sector as today we registered a double inside day. In a good market, this should follow through tomorrow and close the week strong.

LRCX: Even tighter risk on this name than compared with AMAT. Same rules apply!

I highly encourage you to start tracking this setup and build a chart book… over time you’ll train your eye and build a new money-making edge at the same time!

Talk soon,

Greg

Free Chart Book: https://gregduncan.gumroad.com/l/wmfsd

2022 Best Charts: https://gregduncan.gumroad.com/l/2022

Earnings Gap Up Mastery Free Email Course: https://upsideunlimited.com/earnings-gap-course