Situational awareness will save you $$

A quick excerpt on why situational awareness is so important in trading

As I continue to study the world’s best traders, it’s clear that they have developed an intuition and feel for what the market is going to do. In some ways, they are predicting (which in the general CANSLIM field is frowned upon, as we’re taught to interpret, not predict).

One of the exercises I’m putting myself through on a daily basis is trying to connect the current environment to something I’ve experienced in the past. This allows me to gauge my expectations, develop a clear plan, and execute from a position of experience.

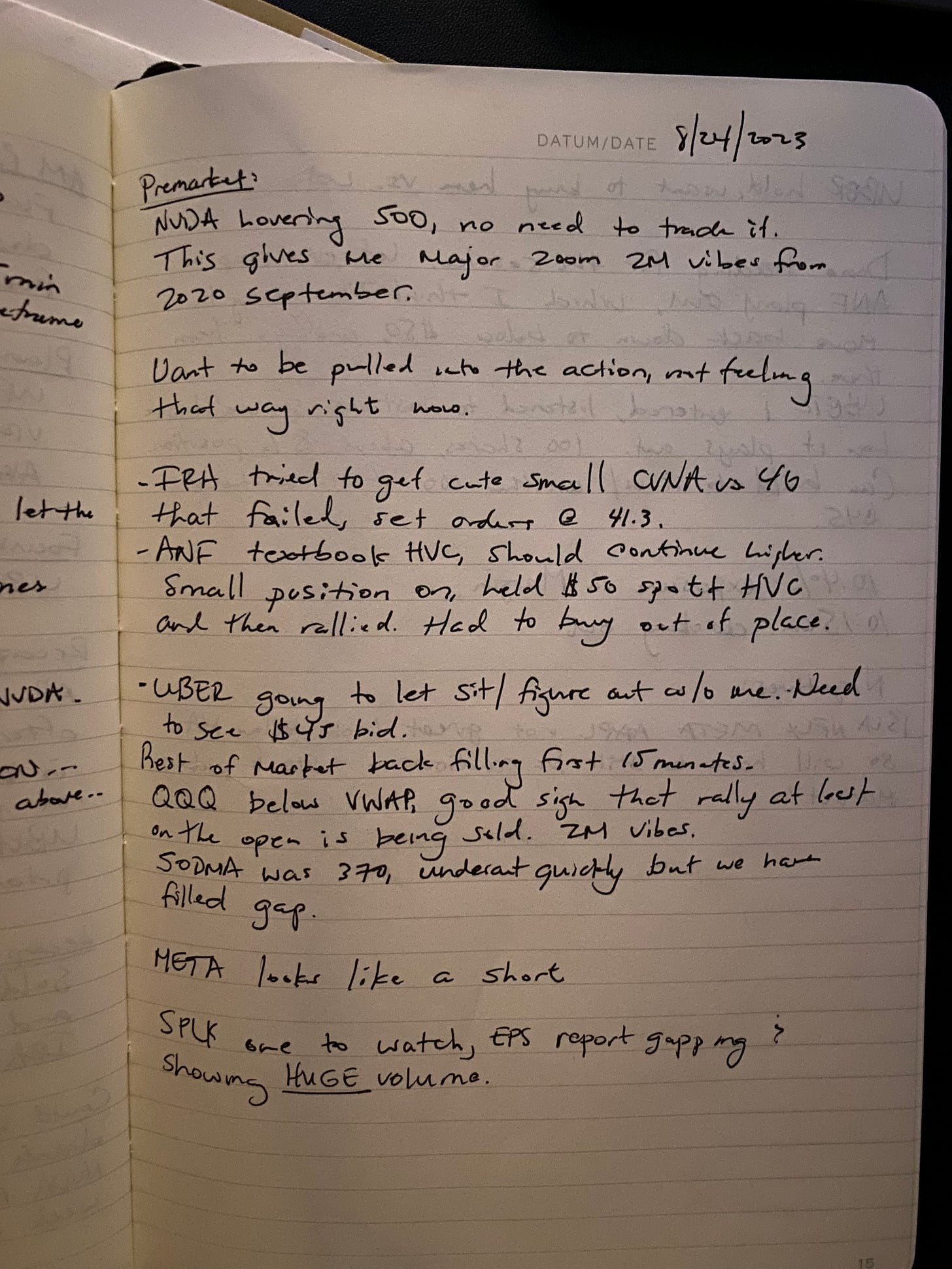

Today’s session worked out well thanks to this ongoing mental training. Here are my notes from premarket:

One of my key takeaways about last night’s NVDA gap-up & this morning’s premarket action was that things weren’t up as much as they should’ve been based on the numbers NVDA posted. In fact, I was surprised to see NVDA not up another 5-10% from last night’s post-market close. This snapped me back to a time when ZM gapped up huge on EPS but then failed to follow through.

The environment is definitely different today than it was in September of ‘20, but this ZM earnings marked a short-term top and we spent the next few weeks correcting. Coincidentally enough, TSLA (the other leading stock at the time), had topped out on the session prior. It closed the ZM earnings reaction session down nearly 5%, which again is a warning sign.

The key takeaway: If good news can’t drive the market higher, we may be in some trouble short term.

How Situational Awareness Shaped My Plan Today:

Keep reading with a 7-day free trial

Subscribe to Upside Unlimited to keep reading this post and get 7 days of free access to the full post archives.