The Secret to Growing as a Trader

Some of the little things that make a big difference

I’ve hammered the table on the importance of conducting daily and weekly routines, including taking a deep dive into the most important aspects of post-trade analysis. These are the obvious things you need to be doing on a daily basis to become a better trader.

But, what about the not-so-obvious things? I’ve been thinking about these more and more over the past couple of weeks, and have come up with an actionable list to help you unlock growth as a trader (just as I am trying to achieve every single session).

Here we go:

Actionable Exercise #1: Qualities of a Successful Trader

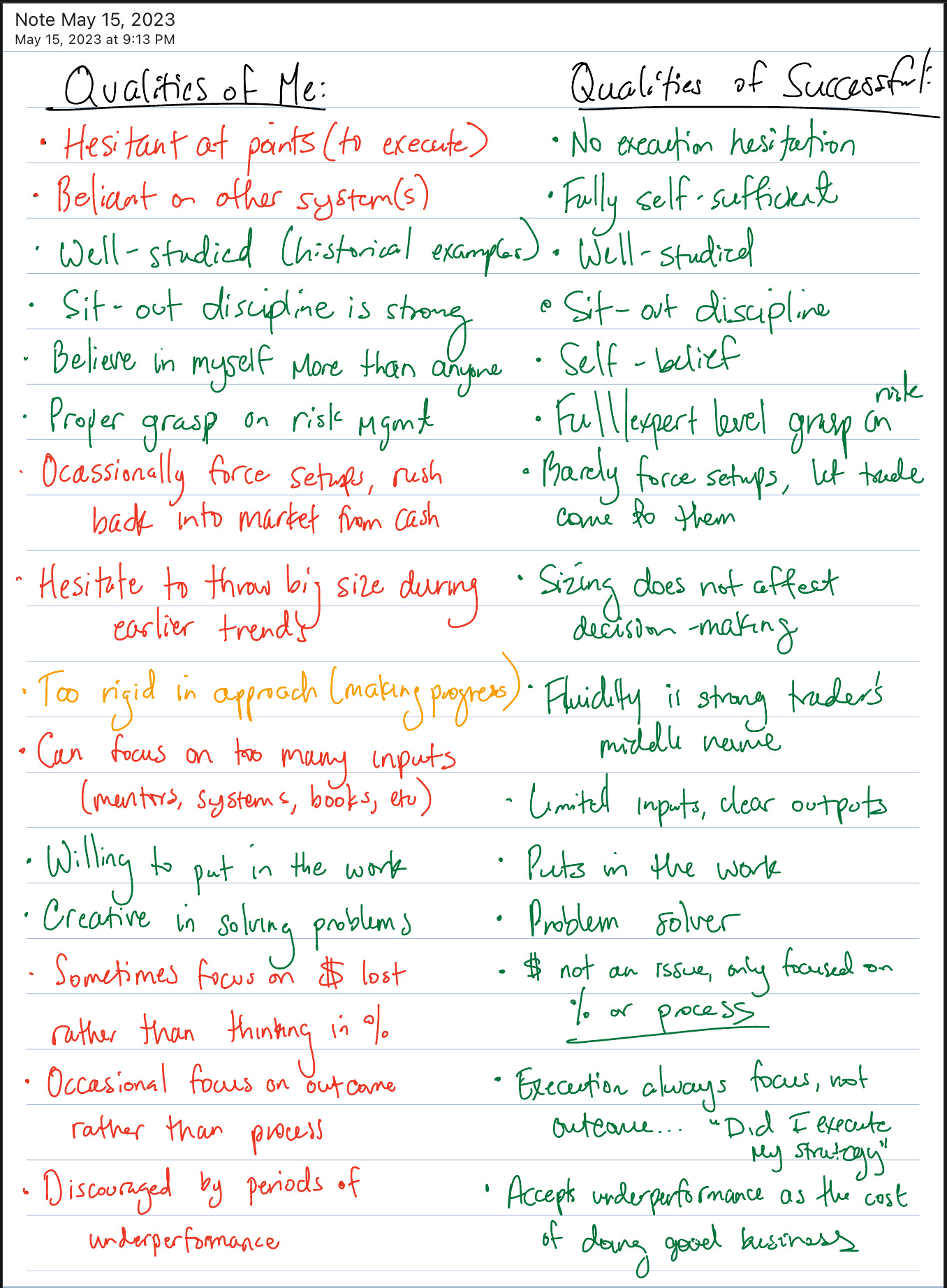

One of the most important thought experiments you can do for your trading is to compare your current qualities as a trader vs. the qualities of an already successful trader.

The growth lies in the discrepancies between what qualities you possess and what qualities a successful trader possesses. Let’s break down each of the two steps:

Step 1: Make a list of all of your current qualities as a trader. Good & bad.

A deep look at your qualities is the most important piece of this exercise. If you want to get better at anything in life, you have to look at the traits you embody on a daily basis that are holding you back from reaching the next level. At the same time, you also need to understand the positive characteristics you have that build the foundation for your growth.

Step 2: Make a list of all of the qualities of a successful trader. Good & bad.

Once you’ve gone through your own list, it should be clear what qualities a successful trader has that you don’t.

From this point on, you can develop an action plan centered around making these differences become similarities.

Here’s an attempt of mine at this exercise earlier in May:

I’ve outlined the overlapping qualities in green, the work in progress in yellow, and the qualities I need to improve on in red.

I now will use this list as a reminder (everyday) of the areas in which I need to improve upon, and come up with actionable tasks behind doing so. For example, a lot of the mental errors behind hesitation can be solved by diving in to root causes, which I’m learning more about through my study of The Disciplined Trader by Mark Douglas.

Earnings Season is upon us and there have been a ton of opportunities to make money so far this quarter. I solely trade Earnings Gap Ups using the High Volume Close setup, which I’ve created a 5-day email course around here:

Actionable Exercise #2: Printing Things Out On Your Desk

A great way to improve as a trader is to print things out and place them on your desk, wall, or office area as visual reminders of the trader or qualities you must embody to become the trader you know you can be.

One of the greatest traders of all time, Paul Tudor Jones, has a large piece of paper on the wall that says, “LOSERS AVERAGE LOSERS”. I imagine he uses this as a reminder to not average down, something no trader or investor should ever do.

I’ve heard stories of traders putting their rule set on their desks to constantly remind them of the process by which they should be operating in the market.

Here’s a video from my good friend Richard Moglen talking with legendary trader Jim Roppel about the various notes he keeps on his desk (3min video):

The point is this: if you want to improve as a trader, consider printing out charts, statements, reminders, rules, motivational quotes, etc on your desk and using them to stay sharp during the trading session.

Exercise #3: Meditation, Visualization, & Daily Affirmations

I was recently talking to one of the co-founders of GammaEdge about trading psychology and the level of importance it has to overall success as a trader long term.

The best traders are able to reach a mental state of mental clarity and precision, whether this be through meditation, daily journalling & visualization, daily affirmations, or a combination of all 3. They have spent a good amount of time mastering the mental side of trading, something not a lot of traders do.

Market wizard Mark Minervini is open about his premarket routine, and meditation is a large piece (click on Mark’s name above to go to the twitter video):

Another way to make sure your mind is ready to navigate the session is through visualization. The goal is to spend 5-10 minutes thinking through all of the different scenarios that could play out during the session, especially those centered around how you’ll execute upon your focus list.

It’s no secret that professional athletes make this a serious part of their routines, and there’s nothing stopping us as traders from doing this as well.

Summing It All Up:

To help unlock our growth potential as traders, there are a ton of different things we can be doing on a daily basis.

The 3 actionable exercises that I’ve laid out above are the following:

1. Highlighting Similarities & Discrepancies of a Successful Trader vs. You

2. Using Visual Queues To Stay On Track

3. Focusing On Meditation, Visualization, and Affirmations

To sum it all up, improving as a trader requires a holistic approach. It's not just about technical or fundamental analysis; it's about self-reflection, discipline, and cultivating a strong mindset. By implementing these actionable exercises and consistently working on our skills and qualities, we can become better traders and take little strides to achieve our goals.

I hope this has been helpful and talk to you next week,

Greg

That's it Greg. Lots of newbie traders think they can achieve consistent profits by stumbling upon some kind of magical indicator or blindly following some account on fintwit. But, the truth is, they aren't willing to put in the sweat and hustle needed to truly master and excel in trading. You're doing awesome! Keep grinding and pushing forward.