Trading The High Volume Close Setup

Everything you need to know.

Today at a glance:

The HVC Setup

Key Entry/Exit Tactics

Historical Examples Guide

Free Email Course (taking the next step)

Let’s dive in:

Understanding the High Volume Close (HVC)

When a stock experiences a gap up in price on exceptionally high volume, it's a clear sign of institutional accumulation. This gap up, often triggered by earnings announcements or major news events, sets the stage for my favorite setup in the market, the High Volume Close (HVC).

The HVC is more than just a price point; it's the foundational piece of successful gap up trading.

Key Indicators in the HVC Setup

Our focus in the HVC setup is not just on any high volume but on the highest volume. Here's what you should be meticulously screening for:

Highest Volume Ever (HVE): This is a clear indicator of unprecedented interest in the stock.

Highest Volume in 1 Year (HV1): It shows the stock is garnering attention it hasn't seen in a significant timeframe.

Highest Volume Since IPO Week (HVIPO): For relatively new stocks, this is a crucial indicator of growing institutional interest.

Highest Volume Since Last Quarter (HVQ): This indicates a renewed interest following the company's earnings report or other news event.

But volume alone isn't enough. I look for stocks that not only experience a high volume surge but also demonstrate:

A Strong Daily Price % Change: Anything over 10% is notable, but the higher the percent change on the day, the better.

A Strong Daily Closing Range: We ideally want to see the stock closing at 75% or higher of its daily range on the gap day. 50% is usually the lowest end DCR that I’ll trade.

Position Relative to Historical Highs: A gap to new highs is preferable, but a gap within 20% of prior highs is also significant. There are also instances in which trades coming out of bottoms perform incredibly well, as sentiment undergoes massive changes — quickly.

Why These Factors Matter

These criteria are not randomly chosen; they are the bedrock of identifying stocks that have the backing of big players. Institutional demand often precedes major price movements, making these stocks prime candidates for significant gains. And, there’s no more obvious sign of institutional accumulation than a massive gap up.

Let’s dive deep into some examples, as well as Entry/Exit tactics:

Entry Tactics: Timing Your Move

In the realm of HVC, timing is everything. Here’s how I determine the optimal entry point:

The High Volume Close (HVC) as Your Entry: The closing price of the gap-up day serves as our primary entry point. This price level, marked by significant trading volume, acts as a strong indicator of institutional commitment. Entering near or at the HVC allows us to ride the momentum created by major players while also being able to effectively manage risk.

Daily Price % Change Consideration: A strong daily price percentage change, particularly over 10%, is a green flag. It suggests a robust price movement, often backed by substantial buying interest. The higher this percentage, the stronger the momentum we give ourselves the opportunity to capture.

Assessing the Daily Closing Range (DCR): A closing range of 75% or higher is ideal, indicating that the stock has not only risen but also retained most of its gains by the market close. A minimum DCR of 50% is our threshold, ensuring we’re engaging with stocks that have shown significant strength throughout the trading day.

Exit Tactics: Protecting Your Investment

While the HVC entry is about getting in, exit is all about risk & trade management:

Setting a Hard Stop-Loss: I typically set a hard stop-loss at 3-5% below the HVC. This stop-loss acts as a safeguard against adverse market movements, ensuring that we limit potential losses while giving the stock enough room to fluctuate.

End-of-Day Close Assessment: An additional exit criterion is an end-of-day close below the HVC. This tactic depends on market conditions and overall sentiment. If the stock closes below our HVC benchmark at the end of any trading day, it might signal a weakening of institutional support, prompting us to exit.

Exiting With Gains: I have adjusted my profit sell rules over the past two years to match the following:

1/3 at 1R (usually 5%)

1/3 at 2R (usually 10%)

Let the rest run vs. the 10EMA…

Why These Tactics Are Crucial

These entry and exit tactics are not just about making trades for the fun of it; they're about making smart, calculated decisions. By setting precise entry & exit points BEFORE I enter the name, I’m able to control emotions while executing and living with the results.

Let’s now get into a couple of examples:

Example #1: A Textbook HVC Play

Stock: $TWLO (2020)

Scenario:

HVC Indicator: This stock exhibited the Highest Volume Ever, signaling strong market interest.

Price Movement: The stock gapped into new highs with a strong daily price % change.

Daily Closing Range (DCR): It maintained a DCR of over 75%, indicating sustained buying interest throughout the day.

Outcome:

The stock demonstrated a robust follow-through, surging over 165% post-HVC. This is a classic example of how a textbook HVC setup can lead to substantial gains.

Example #2: Dual Instances of Success

Stock: $UPST

First Instance:

HVC Indicator: Displayed the Highest Volume Ever.

Price Action: Gapped to New Highs with a strong daily price % change.

DCR: Maintained a DCR greater than 75%.

Outcome:

Resulted in a swift 43% move in just 2 sessions.

Second Instance:

HVC Indicator: Exhibited the Highest Volume Since Last Quarter.

Price Movement: Gapped near prior highs with significant daily price % change.

DCR: Again, a DCR greater than 75%.

Outcome:

Led to an impressive 135% move in 2.5 months.

Example #3: Consistency in Performance

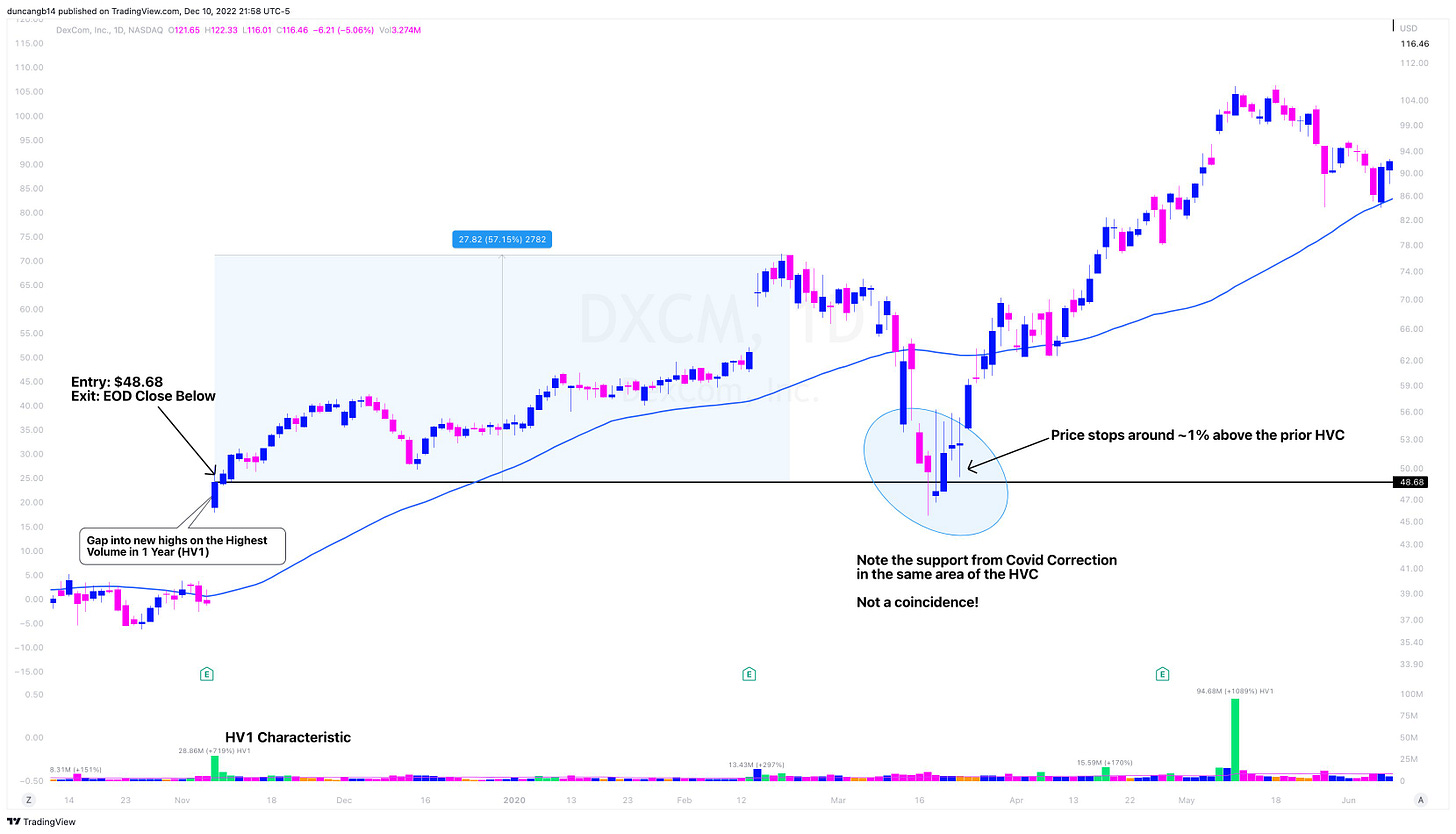

Stock: $DXCM

Scenario:

HVC Indicator: Demonstrated the Highest Volume in 1 Year.

Price Action: Gapped into highs with a notable daily price % change.

DCR: Exceeded 75%, reflecting strong end-of-day positioning.

Outcome:

The stock saw immediate follow-through, yielding a 55% increase. It later found support in this area during the COVID correction, showcasing the lasting impact of a strong HVC setup.

Example #4: The Unexpected Turnaround

Stock: $BROS

Scenario:

Unique Aspect: Here, BROS presented a variation with an HVE gap down that resolved upwards.

HVC Indicator: Highest Volume Ever.

DCR: Maintained a DCR above 75% despite the initial gap down.

Outcome:

The stock didn’t just recover; it soared, achieving a 115% increase. This example highlights the versatility of the HVC strategy and its ability to adapt to different market scenarios.

Taking The Next HVC Step

Earlier this year, I spent a couple of months putting together a free email course on everything I know about finding and trading profitable HVC setups. Within this email course, you’ll take everything you’ve mastered today to the next level:

Improved Trade Timing | 2 Entry Scenarios

Optimized R:R | Advanced Sell Rules

100s Of Examples To Study From

And like I said above, it’s completely free! Sign up for that here:

Other resources to study:

2020 Best Charts: https://gregduncan.gumroad.com/l/wmfsd

2021 Best Charts: https://gregduncan.gumroad.com/l/2021

2022 Best Charts: https://gregduncan.gumroad.com/l/2022

Consider Becoming A Paid Upside Unlimited Subscriber: https://upsideunlimited.com/sub