Wedge Pops & Liquid Stocks Lead The Day

Some of the notable names from my scans tonight

Tracking the market as best as you can while away from your normal setup (whether this be for work/other travel or other circumstances) is a rewarding habit to put yourself through. It allows you to stay in sync with the market action, even if you don’t have $ at work. This allows you to come back to your normal setup in a good flow and ready to execute.

While I’m away from my normal setup (like I am now), my nightly routine is shortened, but I still review the following scans + watchlists:

Gappers Scan

Liquidity/Pure Volume Scan

10%+ Gainers

I’ve gone through the exact criteria behind these scans numerous times for my Paid Upside Unlimited subs. If receiving weekly scans is something that you’ll find valuable, consider upgrading to paid below:

I’ll then go through the following watchlists:

Gappers

IPOs

HTFs

Liquids

Wide Focus

Trade Focus

Even if I’m not going to trade tomorrow, I still put myself through the process and treat every single trading day as an opportunity to improve my discipline and dedication.

With that being said, here are the names/action that caught my eye tonight:

Key Liquid Names To Establish Positions In

One of the key markers of a tradeable trend is how the liquid names in the market are performing on a net basis. If these names aren’t getting attention, it’s likely there aren’t many places to park big $, and any sort of rally may be short lived. That’s why I was pleased to see the following names show positive action today:

AAPL: Real strong move through the 20EMA + Horizontal Resistance. Note the volume, shows some powerful buying after setting a clear topside pivot. A weakness retest of this level tomorrow morning would be nice to set the pattern further.

GOOG: Has been the strongest stock out of the major liquid names. Trading above all moving averages and still holding the EPS gap up from late July.

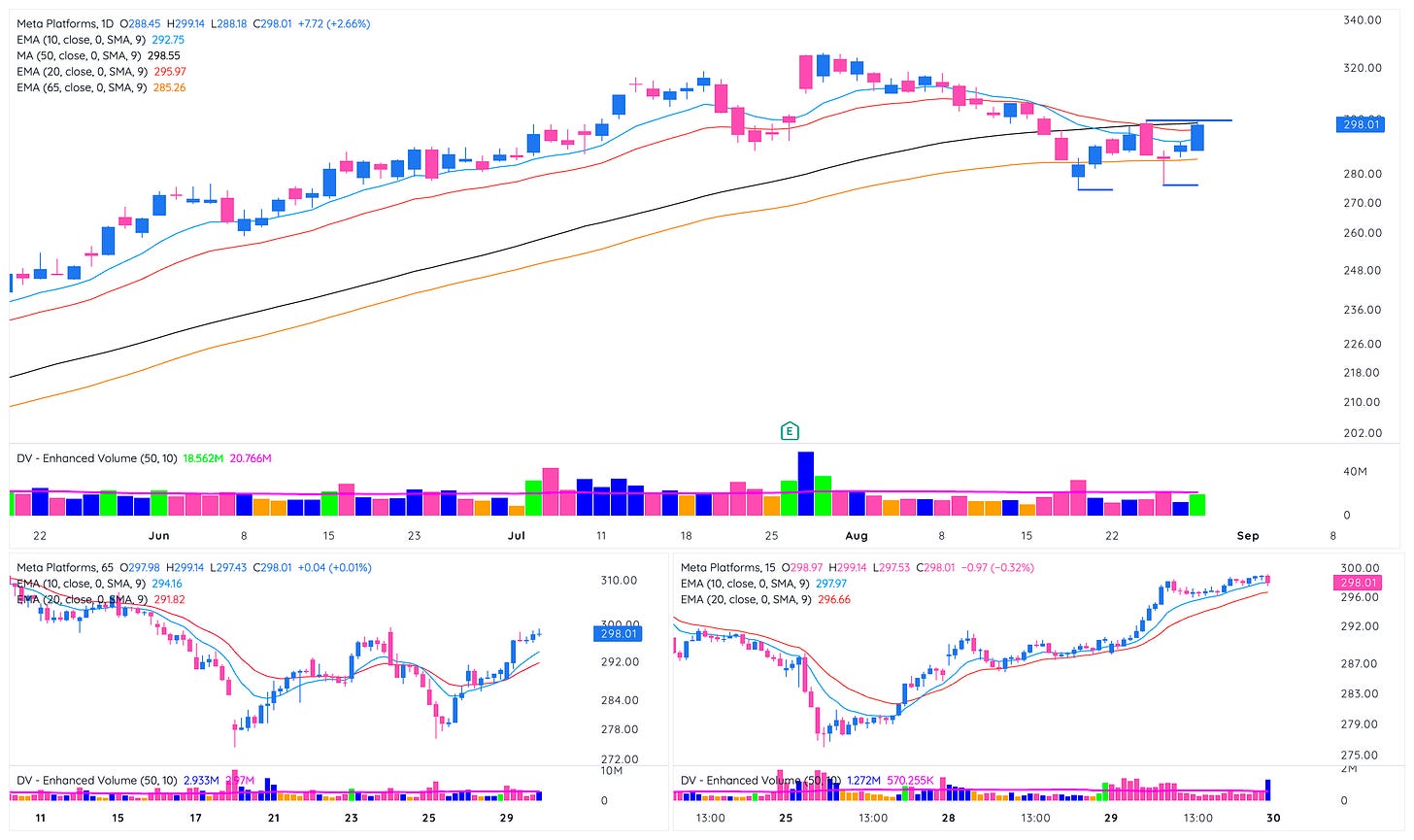

META: Higher lows on the daily timeframe, looking at the 300 level + confluence of 50DMA above as resistance. A move through there after a couple more sessions of consolidation would set this stock into big time motion.

NVDA: Best stock in the market and continues to act well after rebounding from rising 20EMA. Will note the wide and loose feel to the pattern currently but seems to be responding well after weakness late last week. Watching 10/20EMAs for support on the daily as well 65min. Rally to $500 and consolidate seems like a logical thesis going forwards.

RIVN: Decent move into the MAs today, would’ve liked volume to have been higher but it is what it is. Will continue to track for consolidation along with TSLA

TSLA: Think this, NVDA, and UBER are the places to be for me. Will be stalking all 3 relentlessly into next week to try and get positioned on weakness. Today’s move was a massive pop through the $242 spot as well as MAs. Topside 50DMA resistance makes sense, would want to see a test of rising 10/20EMAs over next couple of sessions to set pattern pressure a little more.

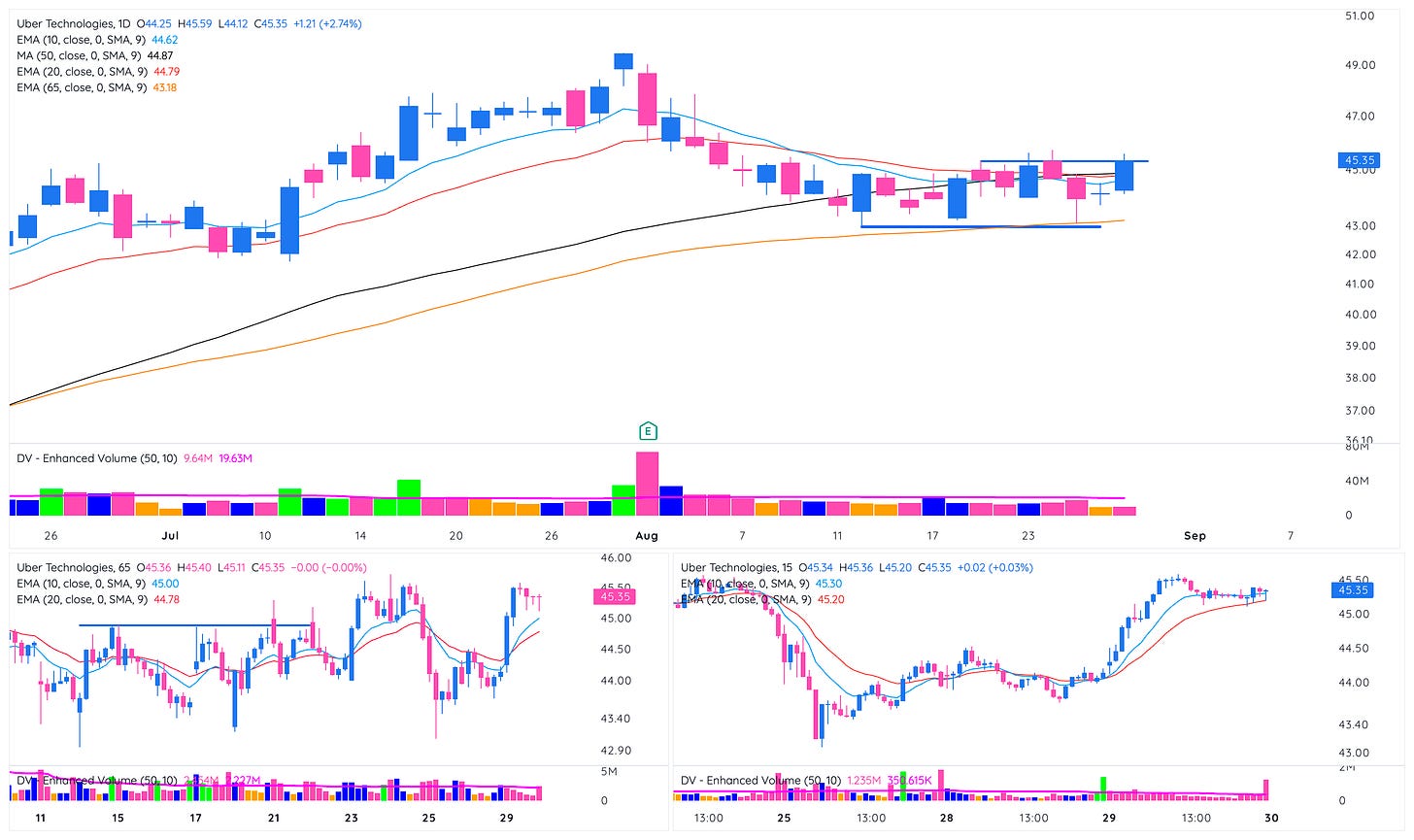

UBER: Feels to be lagging the index a tad, am closely tracking the action above $45.5, which has been serious resistance on the 65min timeframe. Yesterday’s low would be a good stop if we got moving through this level with some volume…Note the inside day setup yesterday and technically triggering/closing above today (even though volume was lacking).

There are multiple other gappers names that are holding up and trading well, namely

VRT

SPLK

FN

AFRM

ANF

AKAM

FRSH

All in all, price action continues to tell an impressive story. Will see if we can get some back and fill here over the next couple of sessions after rallying strong for 3 days straight. Here’s a look at where the general markets are:

SPY (thoughts on chart)

QQQ: Now trading above all MAs as well, major positive. Action feels loose still, so a restest of MAs may be in order.

Final Takeaways:

There has been a lot of strong action over the past couple of sessions, and I’m not in the mood to chase strength (and frankly, neither should you).

My best course of action is to see how we respond* to the first wave of profit-taking, which can occur at any point (or not…). This will be better information than any sort of up day or ‘Follow Through Day’ can give us.

So, with that being said I’ll be in cash, continuing to build out lists and track the names I’ve mentioned above.

Hope this has been valuable,

Greg

Other resources to study:

2020 Best Charts: https://gregduncan.gumroad.com/l/wmfsd

2021 Best Charts: https://gregduncan.gumroad.com/l/2021

2022 Best Charts: https://gregduncan.gumroad.com/l/2022

Earnings Gap Up Mastery Free Email Course: https://upsideunlimited.com/earnings-gap-course

Consider Becoming A Paid Upside Unlimited Subscriber: https://upsideunlimited.com/sub