The High Volume Close Setup | Sell Rules

Your ultimate guide to managing risk with the HVC setup.

Today at a glance:

High Volume Close Refresher

2 Sell Rules On Weakness

3 Sell Rules On Strength

40+ Names To Study From 2023

Let’s dive in:

Two weeks ago, I covered the High Volume Close setup in great detail in a free newsletter edition. You can read that here. Since publishing, I’ve gotten a ton of questions about specific sell rules — whether this be on strength or on weakness.

I’ll answer all of those today, but first I want to start with a quick refresher on the High Volume Close (HVC) setup. The basic idea is this:

When names report good earnings, institutions forget about subtle accumulation. They gap price up on huge volume, giving us retail traders an incredible opportunity to ride along strong momentum bursts.

Learning how to…

Spot/Scan

Enter

Exit*

…these names will have a major impact on your profitability long term.

*This week’s focus will be on sell rules. Let’s dive in:

High Volume Close | Sell Rules

Whenever trading a setup, it’s best practice to have sell rules on both strength and weakness.

Having sell rules on strength allows you to:

i) create consistent habits around taking profits

ii) ensure gains never turn to losses

iii) allow compounding to work

On the other hand, weakness sell rules allow you to:

i) manage risk properly

ii) position size correctly

Let’s start with selling on weakness, diving into the two approaches I’ve used to manage risk with the HVC setup.

Selling The HVC On Weakness

There are two scenarios to keep in mind when setting stop losses using the High Volume Close.

Scenario #1: Prior Intraday Pattern

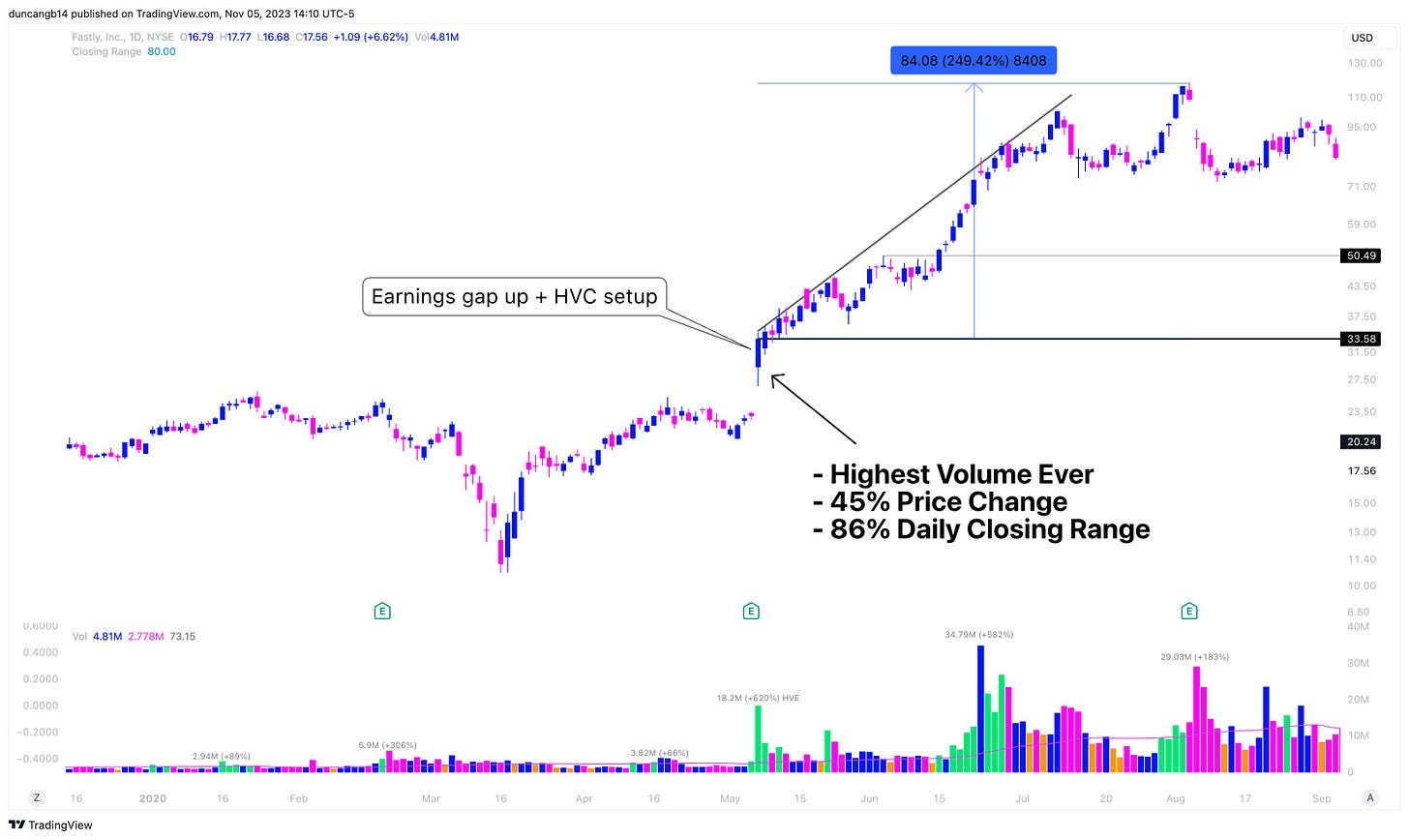

This is the most accurate and consistent way to manage risk with the HVC setup. All it takes is study of the Day 1 gap day’s price action. Let’s show some examples:

Example #1: DKNG

In the bottom panel, I’ve highlighted a consolidation on the 15min chart within the Day 1 gap up price action. I’ve also plotted the HVC so you can see what intraday action around a important support level is supposed to look like.

Identifying this spot on the Day 1 price action allowed me to enter DKNG with less than 3% risk, able to capture over a 15% upside gain. This is about a 5R trade!

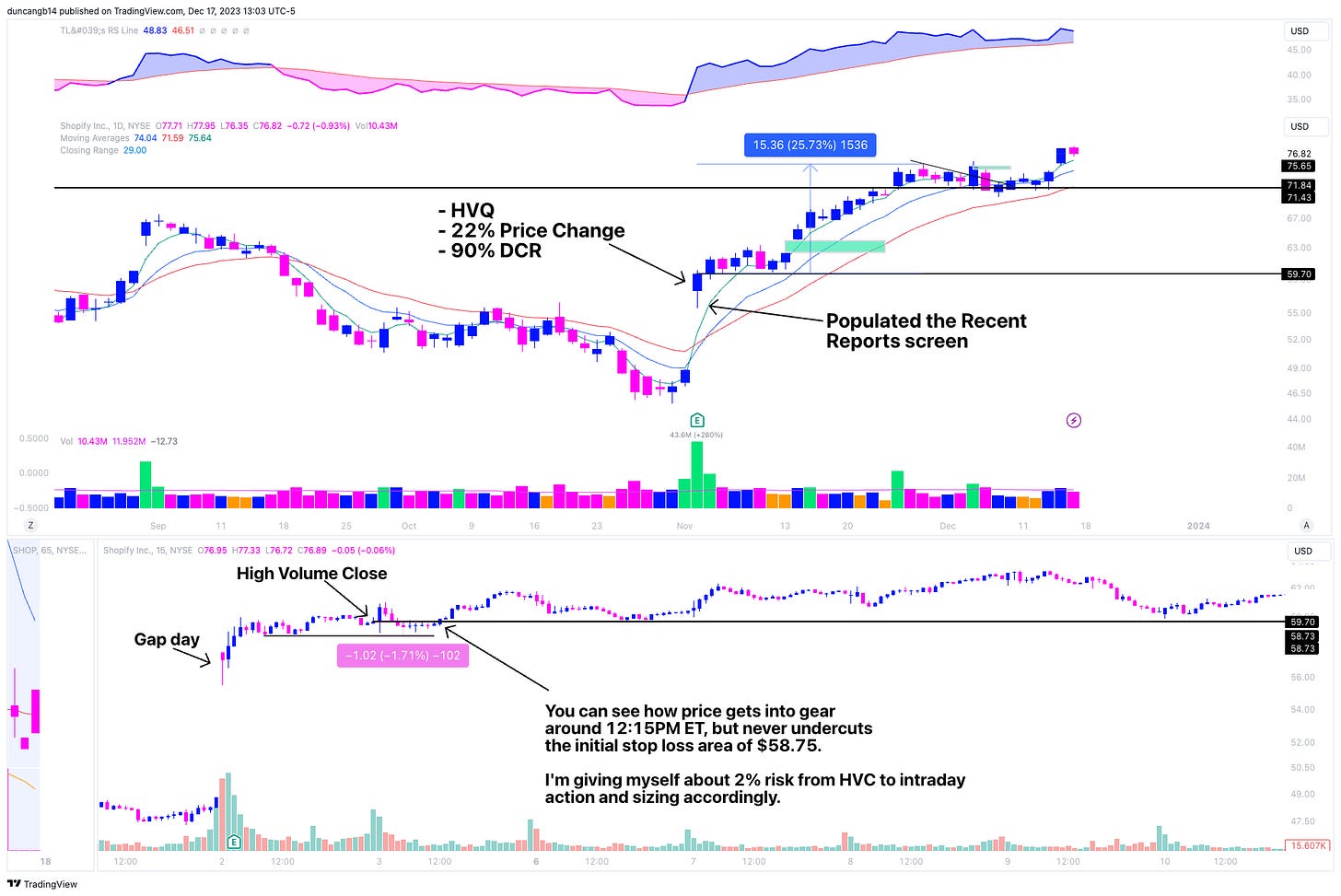

Example #2: SHOP

In the bottom panel, I’ve highlighted another consolidation within SHOP’s Day 1 gap price action. The HVC is also plotted so you can visualize price action against this key line of support on the days following the gap up.

In this example, I’m able to set a logical stop loss just under 2% away from my entry point. You can see how in the right environment, price action is tight and rational. We held where we needed to, and after a couple of days’ consolidation post gap, we went on a 25% run with only risking 2%.

This is the power of using technical price action to place logical stops to manage your risk.

What If You Can’t Find A Logical Area On The Day 1 Gap?

There are two ways to approach this issue:

You don’t trade the Day 2 setup

You set an arbitrary % stop based on $ at risk

The first approach is self-explanatory: if you can’t find an area to manage risk against, you don’t take the trade. I’ve started to lean more and more towards this approach as I fully adopt an abundance mindset.

Scenario 2, setting an arbitrary % stop, allows you to still partake in the action while also managing your risk. If this is the case, I always size down knowing that regular price movements can stop me out until I find a proper intraday pattern to trade against.

Selling On Strength

Alright — we’ve covered sell rules on weakness. We now know how to approach making sure our asses are covered on the downside.

Let’s now talk about the art of selling into strength and the 3 ways I approach it:

Approach #1: Selling Based on R Multiples

This is a simple guide to selling on strength — you’ll want to sell portions of your position when they reach multiples of your risk. You can also apply the same logic to fixed percent gains as well.

Here’s a cookie-cutter outline to doing so:

Sell 1/3 at 1R or fixed % gain

Sell 1/3 at 2R or fixed % gain

Sell 1/3 trailing stop or fixed % gain

Typical fixed % gains can be dependent on your:

Average winner % gain over last 10 trades

Rigid % gain rules (5%, 10%, 20%)

The main takeaway with this scenario is that your sell rules on strength don’t have to be fancy. The main goal is to use as little thought/discretion as possible, so setting rigid rules like this allow you to build consistency in action.

You can adjust these as you get more wins under your belt and calibrate the HVC setup to your style as a trader.

Approach #2: Selling Based on Moving Averages

One of the areas I’m backtesting now is selling based on the following MAs:

Sell 1/3 on a close below 4EMA

Sell 1/3 on a close below 10EMA

Sell 1/3 on a cross of 4 & 10EMA

Again, trying to keep it super simple here.

Approach #3: Combination Of The Two Above

There's an art to selling on the upswing, and it starts with knowing your personality and problems as a trader. Over the past year, I’ve begun to implement a combination of the approaches above to best fit who I am in the market.

So, my exact sell rules are the following:

1/3 at 5% gain

1/3 at 10% gain

1/3 on a close below the 4EMA/10EMA depending on price action.

Example #1: GPS

I followed the plan above. I sold 1/3 at 5%, 1/3 at 10%, and then the final 1/3 I closed below the 4EMA.

Knowing where I was on my recent trades (1 for 3 in terms of them working), I wasn’t willing to let this winner come back to the 10EMA. I elected to sell as price closed below the 4EMA (which was strong support) for the first time since the initial move began.

Example #2: SHOP

I followed the plan above. I sold 1/3 at 5%, 1/3 at 10%, and then the final 1/3 I closed below the 10EMA.

I was more willing to let this trade come back to the 10EMA because I was up 20% and had other names working, so account was still progressing. Then, when we undercut the 10EMA and prior volume day, I was out.

Simple as that.

Other FAQs:

When do I move up my initial stop loss to breakeven?

I move my initial stop up when the trade has reached 1R. This does take some art though because if price doesn’t make super strong progress right out of the gate (like SHOP) it’s easy to micromanage the trade and choke it off. I have to be willing to buy back if get stopped and price closes above the HVC on that same day.

How much should I be risking per trade?

I’m risking anywhere between 0.25%-0.5% of my account on these setups. If my recent performance is strong, I’ll open up my risk profile to 0.75% of my account. Rarely do I allow a 1% loss on these setups anymore.

What if I’m a longer timeframe trader?

Awesome! I’ve developed the sell rules above based on my issues as a trader. 2023 was a year of drawdown for me, so I’m looking to give less back. This means I’m selling more earlier. You have to adjust your sell rules to who you are.

What are the best moving averages to use for the HVC setup?

I use the:

4EMA

10EMA

20EMA

Rarely do I let a trade get to the 20EMA due to my issues stated above. So, I’ve been more aggressive with tracking and executing positions when they interact with the 4EMA or the 10EMA (given these MAs are above my average cost).

Wrapping Up

I’ve now given you everything I implement on a daily basis to trade the HVC setup. To wrap up today’s edition, I’ve collected 40+ examples that you can test these rules with by hand.

2023 Winners List:

ACLX AFRM AMD ANET ANF APP AYX BHVN BMEA BPMC CYBR DASH DDOG DKNG DRCT DUOL EXPE FTDR GDDY GLOB GPS GRMN INFA IT LAMR LDOS LMND LOGI MGNX MSTR PINS PLTR QCOM ROKU S SCS SHOP SONO SQ TGTX TMDX TWST UBER UDMY UIS YPF

Highly recommend importing them into your charting platform and going through them one by one.

That’s all for today.

Talk soon,

Greg

Hi Greg, 2023 was a drawndown year because you let profit turns into loss ? What was other possibles causes for your losses, overall market conditions? When you sell your stock, do you keep it on your radar to a possible continuation breakout or do you trade only gaps up?